Genus philosophy on Corporate Governance is inherited by honesty, transparency, equity, and accountability. The Company is committed to follow ethical demeanor and transparency in the conduct of its operations. Genus believes that trust and transparency is the essence of every relationship and therefore always endeavors to maintain the trust and transparency in all its relationships. Over the years, Company has strengthened its policies and practices to achieve the highest level of Corporate Governance. The Company always endeavors to demonstrate good Corporate Governance practices by complying with all the statutory requirements and voluntarily adhering non-mandatory requirements.

The Company has complied with the requirements stipulated under the Listing Agreement entered into with the Stock Exchanges with regard to corporate governance

India Ratings and Research (Ind-Ra) ) has upgraded Genus Power Infrastructures Ltd’s (GPIL) Long-Term Issuer Rating to ‘IND AA-’ from ‘IND A+’, on December 07, 2023.

The Outlook is Stable.

The instrument-wise rating actions are given below:-

| Instrument Type | Maturity Date | Size of Issue (billion) | Rating/Outlook | Rating Action |

|---|---|---|---|---|

| Fund-based limits | - | INR 2.91 | IND AA-/Stable/IND A1+ | Upgraded |

| Non-fund-based limits | - | INR 11.0 | IND AA-/Stable/IND A1+ | Upgraded |

| Term loan | March 2029 | INR 0.45 | IND AA-/Stable | Assigned |

| External commercial borrowing (ECB) | - | INR 4.16 | IND AA-/Stable | Assigned |

| Commercial paper (CP)* | Up to 365 days | INR 1.0 | IND A1+ | Upgraded |

| Long-term loan | March 2023 | INR 0.01 | WD | Withdrawn (paid in full) |

| Term loan | March 2023 | INR 0.2 | WD | Withdrawn (paid in full) |

| Non-fund-based limits | - | INR 6.71 | IND AA-/Stable/IND A1+ | Assigned |

| Date of Board Meeting | Purpose | Details |

|---|---|---|

| 13.02.2024 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter and nine month ended December 31, 2023. |

| 09.11.2023 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter and half-year ended September 30, 2023. |

| 10.08.2023 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter ended June 30, 2023. | 04.07.2023 | Notice of Board meeting for Considering and approving recommendation of final dividend and preferential issue of warrants | Inter-alia to transact the following 1)To consider and approve proposal for fund raising by way of issue of share warrants through ‘Preferential Issue’ subject to such regulatory or statutory approvals and the approval of the shareholders of the Company as may be required; 2) To consider and recommend dividend, if any, on equity shares of the Company for the financial year ended March 31, 2023 (FY 2022-23). |

| 23.05.2023 | Audited Financial Results | Inter alia to consider and approve the Audited Financial Results (Standalone and Consolidated) for the quarter and year ended March 31, 2023. |

| 03.02.2023 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter and nine month ended December 31, 2022. | 10.11.2022 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter and half-year ended September 30, 2022. |

| 03.08.2022 | Unaudited Financial Results and Recommendation of a Dividend, if any | Inter alia to consider & approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter ended June 30, 2022 and to consider & recommend a dividend, if any, on equity shares of the company for the financial year ended March 31, 2022. |

| 12.05.2022 | Audited Financial Results | Inter alia to consider and approve the Audited Financial Results (Standalone and Consolidated) for the quarter and year ended March 31, 2022. |

| 28.01.2022 | Unaudited Financial Results | Inter alia, to consider and approve the unaudited standalone and consolidated financial results for the quarter and nine months ended December 31, 2021. |

| 29.10.2021 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter and half-year ended September 30, 2021. |

| 29.07.2021 | Unaudited Financial Results and Recommendation of a Dividend, if any | Inter alia to consider & approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter ended June 30, 2021 and to consider & recommend a dividend, if any, on equity shares of the company for the financial year ended March 31, 2021. |

| 28.05.2021 | Audited Financial Results | Inter alia to consider and approve the Audited Financial Results (Standalone and Consolidated) for the quarter and year ended March 31, 2021. |

| 21.01.2021 | Unaudited Financial Results | Inter alia, to consider and approve the unaudited standalone and consolidated financial results for the quarter and nine months ended December 31, 2020. |

| 23.10.2020 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter and half-year ended September 30, 2020. |

| 29.07.2020 | Unaudited Financial Results and Recommendation of a Dividend, if any | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter ended June 30, 2020 and to consider recommendation of a dividend, if any, on equity shares of the company for the financial year ended March 31, 2020. |

| 10.06.2020 | Audited Financial Results | Inter alia to consider and approve the Audited Financial Results (Standalone and Consolidated) for the quarter and year ended March 31, 2020. |

| 22.01.2020 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter and nine-months ended December 31, 2019. |

| 23.10.2019 | Unaudited Financial Results | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the quarter and half-year ended September 30, 2019. |

| 25.07.2019 | Unaudited Financial Results and Recommendation of a Dividend, if any | Inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) for the first quarter ended June 30, 2019 and to consider recommendation of a dividend, if any, on equity shares of the company for the financial year ended March 31, 2019. |

| 11.05.2019 | Audited Financial Results and Recommendation of a Dividend, if any | Inter alia to consider and approve the Audited Financial Results (Standalone and Consolidated) for the quarter and year ended March 31, 2019 and to consider recommendation of a dividend, if any, on equity shares of the company for the financial year ended March 31, 2019. |

| 22.10.2018 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter and half year ended September 30, 2018. |

| 27.07.2018 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter ended June 30, 2018. |

| 20.07.2020 | Audited Financial Results and Recommendation of a Dividend, if any | Inter alia to consider and approve the Audited Financial Results (Standalone and Consolidated) for the quarter and year ended March 31, 2020 and to consider recommendation of a dividend, if any, on equity shares of the company for the financial year ended March 31, 2020. |

| 11.05.2018 | Audited Financial Results and Recommendation of a Dividend, if any | Inter alia to consider and approve the Audited Financial Results (Standalone and Consolidated) for the quarter and year ended March 31, 2018 and to consider recommendation of a dividend, if any, on equity shares of the company for the financial year ended March 31, 2018. |

| 24.01.2018 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter ended December 31, 2017. |

| 11.11.2017 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter and half-year ended September 30, 2017. |

| 11.08.2017 | Notice of Board Meeting to consider and approve the Unaudited Financial Results for the quarter ended June 30, 2017 and to fix up the date of Annual General Meeting | Inter alia to consider, approve and take on record the Unaudited Financial Results for the quarter ended June 30, 2017; fix up the date, time and venue for convening the 25th Annual General Meeting (“AGM”) of the Company; and note the closure of the register of members and share transfer books for the purpose of AGM and payment of dividend, if declared at the said AGM . |

| 23.05.2017 | Audited Financial Results and Recommendation of a Final Dividend, if any | Inter alia to consider and approve the Audited Financial Results (Standalone and Consolidated) for the quarter and year ended March 31, 2017 and to consider recommendation of a final dividend, if any, on equity shares of the company for the financial year ended March 31, 2017. |

| 31.01.2017 | Interim Dividend | Consideration of declaration of interim dividend, if any, for the financial year ending March 31, 2017 |

| 31.01.2017 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter and nine-months ended December 31, 2016. |

| 26.11.2016 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter and half-year ended September 30, 2016 |

| 19.08.2016 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter ended June 30, 2016 |

| 25.05.2016 | Audited Financial Results and Recommendation of Dividend, if any | Inter alia to consider and approve the Audited Financial Results for the quarter and year ended March 31, 2016 and to recommend dividend, if any. |

| 08.02.2016 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter & nine-months ended December 31, 2015 |

| 09.11.2015 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter and half-year ended September 30, 2015. |

| 12.08.2015 | Un-audited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter ended June 30, 2015 |

| 27.05.2015 | Audited Financial Results and Recommendation of Dividend | Inter alia to consider and approve the Audited Financial Results for the quarter and year ended March 31, 2015 and to recommend dividend, if any |

| 14.02.2015 | Un-Audited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter/nine-months ended December 31, 2014 |

| 14.11.2014 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter/half year ended September 30, 2014 |

| 04.08.2014 | Unaudited Financial Results | Inter alia, to consider, approve and take on record the Unaudited Financial Results for the quarter ended June 30, 2014 |

| 20.05.2014 | Audited Financial Results | to consider and approve the Audited Financial Results for the quarter and year ended March 31, 2014 and to recommend dividend, if any |

| 08.02.2014 | Un-audited Financial Results | Inter alia, to consider, approve and take on record the Un-audited Financial Results for the quarter/nine months ended December 31, 2013 |

| Purpose / Particular | Ex-Date | Record Date (RD) / Book Closure (BC) |

|---|---|---|

| AGM/Dividend-75% | 21.09.2023 | BC = From 21.09.2023 To 28.09.2023 |

| AGM/Dividend-25% | 30.08.2022 | BC = From 02.09.2022 To 08.09.2022 |

| AGM/Dividend-50% | 08.09.2021 | BC = From 10.09.2021 To 16.09.2021 |

| AGM/Dividend-10% | 17.09.2020 | BC = From 19.09.2020 To 25.09.2020 |

| AGM/Dividend-58% | 29.08.2019 | BC = From 31.08.2019 To 06.09.2019 RD: 30.08.2019 |

| AGM/Dividend-41% | 12.09.2018 | BC = From 15.09.2018 To 21.09.2017 RD: 14.09.2018 |

| AGM/Dividend-35% | 14.09.2017 | BC = From 16.09.2017 To 22.09.2017 RD: 15.09.2017 |

| Interim Dividend - 10% | 09.02.2017 | RD: 10.02.2017 |

| AGM/Dividend-25% | 31.08.2016 | BC = From 02.09.2016 To 08.09.2016 RD: 01.09.2016 |

| AGM/Dividend - 20% | 16.09.2015 | BC = From 21.09.2015 To 26.09.2015 RD: 19.09.2015 |

| AGM/Dividend-10% | BC=From 24.09.2014 To 29.09.2014 RD=23.09.2014 | |

| New Shares pursuant to Scheme of Arrangement | 09.01.2014 | RD = 11.01.2014 |

| Dividend-Re.0.10 Per Share | - | BC = From 14.08.2013 To 18.08.2013 |

| Dividend-Re.0.10 Per Share | - | BC = From 22.12.2012 To 29.12.2012 |

| Dividend-Re.0.10 Per Share | - | BC = From 03.09.2011 To 10.09.2011 |

| Face Value Split From Rs.10/- To Re.1/- | 22.10.2010 | RD = 25.10.2010 |

| AGM And Dividend Re.1/- Per Share | 09.09.2010 | BC = From 14.09.2010 To 17.09.2010 |

| Dividend-Re.1/- Per Share | 16.09.2009 | BC = From 18.09.2009 To 26.09.2009 |

| AGM/Dividend - 15% | 22.09.2008 | BC = From 24.09.2008 To 30.09.2008 |

| AGM/Final Dividend-15% | 21.09.2007 | BC = From 25.09.2007 To 29.09.2007 |

| AGM | 21.09.2006 | BC = From 25.09.2006 To 29.09.2006 |

| Interim Dividend-15% | 02.05.2006 | RD = 03.05.2006 |

| AGM/Dividend-5% | 31.08.2005 | BC = From 02.09.2005 To 07.09.2005 |

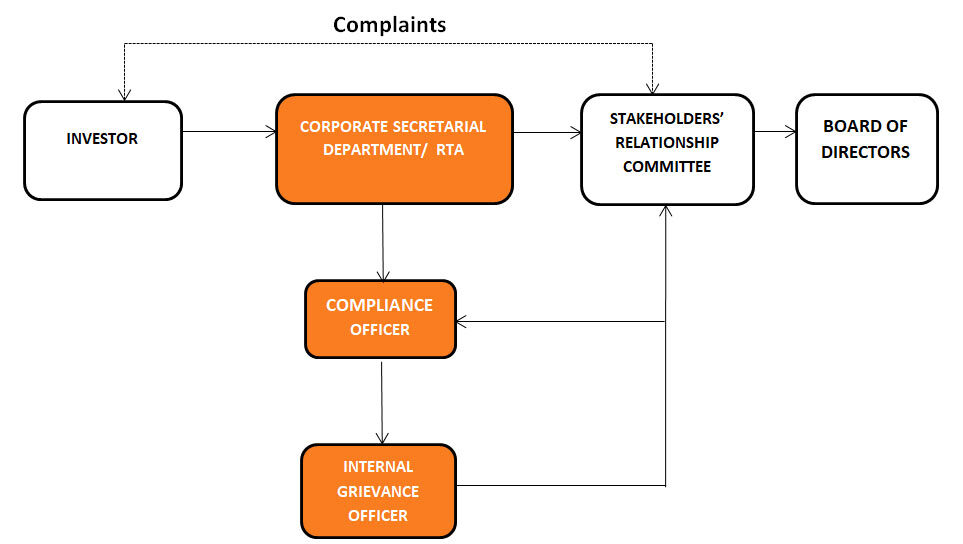

For queries/complaints relating to non-receipt of annual reports, dividend or other investor’s grievances / the designated official of the Company who are responsible for assisting and handling investor grievances / the email address for grievance redressal

The Company Secretary,

Genus Power Infrastructures Limited

SPL-3, RIICO Industrial Area, Sitapura, Tonk Road,

Jaipur-302022, Rajasthan, India

Telephone Nos.: +91-141-7102400/500

Designated E-mail: [email protected]

For queries on Financial Statements/Results:

Investor Relations Officer,

Genus Power Infrastructures Limited

Telephone Nos.: (011) 47114800

E-mail: [email protected]

| Meeting Date | Type of Meeting | Notice |

|---|---|---|

| 28.04.2024 | Postal Ballot | Notice of Postal Ballot |

| 08.01.2024 | Postal Ballot | Notice of Postal Ballot |

| 28.09.2023 | Annual General Meeting | Notice of AGM |

| 31.07.2023 | Notice of EGM | Notice of Extraordinary General Meeting |

| 31.07.2023 | Postal Ballot | Notice of Postal Ballot |

| 08.09.2022 | Annual General Meeting | Notice of AGM |

| 26.02.2022 | NCLT Convened Meeting of the Equity Shareholders | Notice |

| 16.09.2021 | Annual General Meeting | Notice of AGM |

| 25.09.2020 | Annual General Meeting | Notice of AGM |

| 06.09.2019 | Annual General Meeting | Notice of AGM-Proxy-Attendance.pdf |

| 21.09.2018 | Annual General Meeting | Notice of AGM-Proxy-Attendance.pdf |

| 22.09.2017 | Annual General Meeting | Notice of AGM-Proxy-Attendance.pdf |

| 08.09.2016 | Annual General Meeting | Notice of AGM-Proxy-Attendance.pdf |

| 26.09.2015 | Annual General Meeting | Notice+Proxy+Attendance Slip.pdf |

| 29.09.2014 | Annual General Meeting | Notice of AGM_2.pdf |

The Shareholders, who have not yet encashed their dividend warrant(s), are requested to encash their dividend warrant(s), immediately. It may be noted that pursuant to provisions of the Companies Act, 1956/2013, all unpaid/unclaimed dividends, which remained unpaid or unclaimed for a period of seven years, shall be transferred to the Investor Education and Protection Fund (IEPF) established under the provisions of the Companies Act, 1956/2013. In case you have lost/ misplaced those dividend warrant(s), please send us the request letter along with Letter of Undertaking (link to download given below) duly executed to enable us to issue duplicate cheque against the said dividend warrant(s).

| INVESTOR_NAME | FATHER_NAME | ADDRESS | FOLIO / DEMAT ACCOUNT NO. | AMOUNT (RS.) | DUE DATE FOR TRANSFER TO IEPF | FINANCIAL YEAR |

|---|---|---|---|---|---|---|

| PROMOD KUMAR JAIN | SRI BASANTILAL JAIN | SRI BASANTILAL JAIN HOUSE NO 6 GALI NO 4 NAI BASTI BHATINDA BATHINDAPUNJAB 302001 | 020190 | 1000 | 11-OCT-2029 | 2021-22 |

| KAMLESH KUMAR SAIN | KALYAN SAHAI SAIN | KALYAN SAHAI SAIN LIC OF INDIA KHAIRTHAL DT ALWAR ALWARRAJASTHAN 302001 | 020497 | 250 | 11-OCT-2029 | 2021-22 |

| BRIJ MOHAN JAIN | POORAN MAL | POORAN MAL 1-GHA-19, JAWAHAR NAGAR JAIPUR JAIPURRAJASTHAN 302001 | 020559 | 250 | 11-OCT-2029 | 2021-22 |

| PRAMOD KUMAR SHARMA | D D SHARMA | D D SHARMA DHANLAXMI TRADING CO D 19 NEW GRAIN MANDI CHANDPOLE JAIPUR RAJ JAIPURRAJASTHAN 302001 | 020772 | 250 | 11-OCT-2029 | 2021-22 |

| B B GUPTA | R LAL | R LAL DR MUKUL GUPTA 53 A VISHNUPURI NEAR DALDA FACTORY DURGAPURA JAIPUR JAIPURRAJASTHAN 302001 | 020763 | 750 | 11-OCT-2029 | 2021-22 |

| URMILABEN DESAI | MULJIBHAI | MULJIBHAI 1436 AKASH DEEL SOC. BEHIND DIVYA JYOT SOC. MAKARPURA ROAD BARODA - 9 VADODARAGUJARAT 302001 | 020860 | 750 | 11-OCT-2029 | 2021-22 |

| SWATI CHOUDHARY | RANVEER SINGH CHOUDHARY | RANVEER SINGH CHOUDHARY P.N.- 8,SHIV NAGAR, TONK ROAD, SANGANER, JAIPUR JAIPURRAJASTHAN 302001 | 020839 | 250 | 11-OCT-2029 | 2021-22 |

| SHASHI BANSAL | BISHAMBER DAYAL | BISHAMBER DAYAL I-GHA-19, JAWAHAR NAGAR JAIPUR JAIPURRAJASTHAN 302001 | 020855 | 250 | 11-OCT-2029 | 2021-22 |

| RAKESH KUMAR MALHOTRA | D P MALHOTRA | D P MALHOTRA 9/6531 GALI 1 DEV NAGAR KAROL BAGH DELHI 110005 CENTRAL DELHIDELHI 110005 | 020213 | 500 | 11-OCT-2029 | 2021-22 |

| ARUNA SINGHANIA | RAMESH KUMAR SINGHANIA | RAMESH KUMAR SINGHANIA J J ELECTRICAL CORPORATION 1815 BHAGIRATH PALACE DELHI 110006 CENTRAL DELHIDELHI 110006 | 020193 | 750 | 11-OCT-2029 | 2021-22 |

| PRAVEEN KUMAR | BALDEV RAJ | BALDEV RAJ 11-12 GUPTA MOTOR MARKET KASHMIRI GATE DELHI 110006 CENTRAL DELHIDELHI 110006 | 020468 | 750 | 11-OCT-2029 | 2021-22 |

| MEENA SETHIA | BABU LAL SETHIA | BABU LAL SETHIA C/O M/S TECHMECH ENGINEERS 46 SHARDHANAND MARG (G B ROAD) DELHI 110006 CENTRAL DELHIDELHI 110006 | 020192 | 500 | 11-OCT-2029 | 2021-22 |

| MAMTA GROVER | YASH PAL GROVER | YASH PAL GROVER HOUSE NO. 7823-6 ABDUL HASAN MOLABAKSH BUILDING SUBZI MANDI DELHI DELHI 110007 CENTRAL DELHIDELHI 110007 | 1201910101471038 | 25 | 11-OCT-2029 | 2021-22 |

| GARIMA MADAAN | BALDEV RAJ MADAAN | BALDEV RAJ MADAAN 188 VIVEKANAND PURI SARAI ROHILLA NEW DELHI 110007 CENTRAL DELHIDELHI 110007 | IN30051314674988 | 75 | 11-OCT-2029 | 2021-22 |

| GURDEEP ARORA | SURINDER ARORA | SURINDER ARORA K-5/3 MODEL TOWN DELHI 110009 CENTRAL DELHIDELHI 110009 | 020459 | 250 | 11-OCT-2029 | 2021-22 |

| RAKESH KUMAR | SH KUNDAN LAL | SH KUNDAN LAL 7/11 TC NEW MOTI NAGAR DELHI 110015 CENTRAL DELHIDELHI 110015 | 020883 | 2.5 | 11-OCT-2029 | 2021-22 |

| NIRMAL KUMAR | NOTAVAILABLE | NOTAVAILABLE TC - 6/11 NEW MOTI NAGAR NEW DELHI 110015 CENTRAL DELHIDELHI 110015 | 020887 | 2.5 | 11-OCT-2029 | 2021-22 |

| AJAY AJMANI | INDER SAIN AJMANI | INDER SAIN AJMANI WZ-108-A/1 BASAI DARAPUR MOTI NAGAR NEW DELHI 110015 CENTRAL DELHIDELHI 110015 | IN30094010074880 | 5 | 11-OCT-2029 | 2021-22 |

| DEEPTI | MADAN MOHAN | MADAN MOHAN U-13 GREEN PARK EXTN NEW DELHI 110016 CENTRAL DELHIDELHI 110016 | 020458 | 750 | 11-OCT-2029 | 2021-22 |

| PREKSHIT PRASHANT | SUDHIR KUMAR | SUDHIR KUMAR C/O SRI SURENDRA GAUR 21 A JIA SARI HAUZ KHAS NEW DELHI 110016 CENTRAL DELHIDELHI 110016 | IN30209210170186 | 12.5 | 11-OCT-2029 | 2021-22 |

| ARCHANA TIKKOO | RAJIV TIKKOO | RAJIV TIKKOO 26A BLOCK N SAKET NEW DELHI 110017 CENTRAL DELHIDELHI 110017 | 020172 | 1250 | 11-OCT-2029 | 2021-22 |

| ANJU CHAUDHURI | NABARUN CHAUDHURI | NABARUN CHAUDHURI W/O MR UDAYAN CHAUDHURI 40/60 2ND FLR CHITTARANJAN PARK NEW DELHI 110019 CENTRAL DELHIDELHI 110019 | 020171 | 500 | 11-OCT-2029 | 2021-22 |

| VIDYA BHUSHAN BHASIN | KESAR LAL BHASIN | KESAR LAL BHASIN J-7/142 RAJOURI GARDEN NEW DELHI 110027 CENTRAL DELHIDELHI 110027 | 020469 | 1000 | 11-OCT-2029 | 2021-22 |

| GAURI SHANKER GUPTA | B N GUPTA | B N GUPTA 3/5 CHHOTA BAZAR SHAHDRA DELHI 110032 CENTRAL DELHIDELHI 110032 | 020461 | 750 | 11-OCT-2029 | 2021-22 |

| MANI BALA KHEMKA | SATYA NARAIN KHEMKA | SATYA NARAIN KHEMKA 559 MOTI RAM ROAD SHAHDARA DELHI 110032 CENTRAL DELHIDELHI 110032 | 020465 | 500 | 11-OCT-2029 | 2021-22 |

| PAWAN KUMAR KHEMKA | SATYA NARAIN KHEMKA | SATYA NARAIN KHEMKA 559 MOTI RAM ROAD SHAHDARA DELHI 110032 CENTRAL DELHIDELHI 110032 | 020466 | 750 | 11-OCT-2029 | 2021-22 |

| KRISHNA WADHWA | M L WADHWA | M L WADHWA B-4, BHOLANATH NAGAR MAIN ROAD NEAR CHHOTEYLAL MANDIR, SHAHDARA DELHI 110032 CENTRAL DELHIDELHI 110032 | 020885 | 2.5 | 11-OCT-2029 | 2021-22 |

| MANISHA SHARMA | SHIV KUMAR SHARMA | SHIV KUMAR SHARMA HOUSE NO.203/4 RAMESHWER NAGAR DELHI 110033 DELHI DELHI 110033 CENTRAL DELHIDELHI 110033 | 1201330000798953 | 0.25 | 11-OCT-2029 | 2021-22 |

| ROOPA SATWANI | KANHYALAL SATWANI | KANHYALAL SATWANI M-3/D-7, 2ND FLOOR JHULELAL APARTMENTS ROAD NO 44, PITAMPURA DELHI 110034 CENTRAL DELHIDELHI 110034 | 020600 | 750 | 11-OCT-2029 | 2021-22 |

| SATISH KUMAR KANWAR | RAM KANWAR | RAM KANWAR 60/61 SHIV ENC SULTAN GARDEN NJF DELHI NEW DELHI 110043 CENTRAL DELHIDELHI 110043 | IN30051316920708 | 12.5 | 11-OCT-2029 | 2021-22 |

| SANDEEP SHARMA | JAIPARKASH | JAIPARKASH RZ 17 P BLOCK NEW ROSHANPURA NAJAFGARH . NEW DELHI DELHI 110043 CENTRAL DELHIDELHI 110043 | 1208870006062061 | 16.75 | 11-OCT-2029 | 2021-22 |

| ABHISHEK GOYAL | NOTAVAILABLE | NOTAVAILABLE HOUSE NUMBER45 GALI NUMBER15 SOUTH DELHI DELHI 110044 CENTRAL DELHIDELHI 110044 | 1208160027491787 | 12.5 | 11-OCT-2029 | 2021-22 |

| OM PARKASH JUNEJA | VIRBHAN SUNEJA | VIRBHAN SUNEJA G-116 ASHOK VIHAR PH-I DELHI 110052 CENTRAL DELHIDELHI 110052 | 020188 | 750 | 11-OCT-2029 | 2021-22 |

| AUMBRISH KUMAR VARSHNEY | MAHENDAR KUMAR VARSHNEY | MAHENDAR KUMAR VARSHNEY F-33-A SHASTRI PARK DELHI 110053 CENTRAL DELHIDELHI 110053 | 020954 | 0.25 | 11-OCT-2029 | 2021-22 |

| SANJAY KALRA | S K KALRA | S K KALRA 30-A DDA LIG FLATS MOTIA KHAN NEW DELHI 110055 CENTRAL DELHIDELHI 110055 | 020462 | 750 | 11-OCT-2029 | 2021-22 |

| PREMLATA SHARMA | KULDIP CHAND SHARMA | KULDIP CHAND SHARMA 315 VASANT ENCLAVE NEW DELHI 110057 CENTRAL DELHIDELHI 110057 | 020189 | 750 | 11-OCT-2029 | 2021-22 |

| SANJAY KUMAR JAIN | NEM KUMAR JAIN | NEM KUMAR JAIN C/O SANJAY JAIN G 195 FF PUSHKAR ENCLAVE MCDONALD PASCHIM VIHAR WEST DELHI NEAR RADDISON BLUE HOTEL DELHI DELHI 110063 CENTRAL DELHIDELHI 110063 | IN30021412007578 | 0.25 | 11-OCT-2029 | 2021-22 |

| ARTI | KARAN SINGH | KARAN SINGH POST OFFICE UJWA SAMAS PUR KHALSA NEW DELHI DELHI 110073 CENTRAL DELHIDELHI 110073 | 1203320066950271 | 1.25 | 11-OCT-2029 | 2021-22 |

| SANJEEV KUMAR | NOTAVAILABLE | NOTAVAILABLE 347 SHREE AWAS APARTMENT DWARKA SE NEW DELHI DELHI 110075 CENTRAL DELHIDELHI 110075 | 1208160062788772 | 25.75 | 11-OCT-2029 | 2021-22 |

| ASHOK ARORA | TARA CHAND ARORA | TARA CHAND ARORA 29 C MIG FLAT CITIZEN ENCLAVE [NEAR CRPF PUBLIC SCHOOL PLOT NO B-3 SECTOE 14 EXTENSION ROHINI DELHI 110085 CENTRAL DELHIDELHI 110085 | 020206 | 750 | 11-OCT-2029 | 2021-22 |

| SUJATA ARORA | ASHOK ARORA | ASHOK ARORA 29 C MIG FLAT CITIZEN ENCLAVE [NEAR CRPF PUBLIC SCHOOL] PLOT NO B-3 SECTOR 14 EXTENSION ROHINI DELHI 110085 CENTRAL DELHIDELHI 110085 | 020205 | 500 | 11-OCT-2029 | 2021-22 |

| SATPAL | THAKAR DASS | THAKAR DASS E-128 PREET VIHAR VIKAS MARG DELHI 110092 CENTRAL DELHIDELHI 110092 | 020169 | 500 | 11-OCT-2029 | 2021-22 |

| RAVINDER KUMAR JAIN | NOTAVAILABLE | NOTAVAILABLE B 410 NIRMAN VIHAR SHAKKARPUR DELHI 110092 CENTRAL DELHIDELHI 110092 | IN30088813235002 | 500 | 11-OCT-2029 | 2021-22 |

| GOPAL SWARUP | BISHAN SWARUP | BISHAN SWARUP A-11, VIKALP APARTMENTS PLOT NO. 92, 9TH AVENUE I P EXTENSION, PATPARGANJ DELHI 110092 CENTRAL DELHIDELHI 110092 | 021068 | 500 | 11-OCT-2029 | 2021-22 |

| KUSUM LATA | LAJPAT RAI KHURANA | LAJPAT RAI KHURANA A-11, VIKALP APARTMENTS PLOT NO. 92, 9TH AVENUE I P EXTENSION, PATPARGANJ DELHI 110092 CENTRAL DELHIDELHI 110092 | 021069 | 500 | 11-OCT-2029 | 2021-22 |

| RICHA PANDEY | KRISHANA CHANDRA PANDEY | KRISHANA CHANDRA PANDEY B - 6 A / B - 206 STREET NO - 2 NEAR MANGLAM HOSPITAL WEST VINOD NAGAR DELHI 110092 CENTRAL DELHIDELHI 110092 | IN30120910218782 | 0.25 | 11-OCT-2029 | 2021-22 |

| POONAM AGGARWAL | GOVIND PRASAD AGGARWAL | GOVIND PRASAD AGGARWAL F 39 B GALI NO 12 LAXMI NAGAR SHAKARPUR BARAMAD SHAKARPUR EAST DELHI DELHI DELHI 110092 CENTRAL DELHIDELHI 110092 | 1203320035762222 | 25 | 11-OCT-2029 | 2021-22 |

| NIRANJAN KUMAR | MOHAN LAL | MOHAN LAL D 2 424 NAND NAGRI NORTH EAST DELHI . EAST DELHI DELHI 110093 CENTRAL DELHIDELHI 110093 | 1208870094601733 | 7.5 | 11-OCT-2029 | 2021-22 |

| NARESH GUPTA | D R GUPTA | D R GUPTA H NO 154 SECTOR 16 A FARIDABAD 121002 FARIDABADHARYANA 121002 | 020803 | 250 | 11-OCT-2029 | 2021-22 |

| SUSHMA RANI | SANT KUMAR CHOUDHARY | SANT KUMAR CHOUDHARY H.NO- 1016- P SECTOR- 15 PART- II GUARGAON (HARYANA) 122001 GURGAONHARYANA 122001 | IN30211310063400 | 500 | 11-OCT-2029 | 2021-22 |

| MEGHA GOEL | VIJAY KUMAR GOEL | VIJAY KUMAR GOEL CO NIKESH GUPTA HOUSE NO988 SECTOR10 GURGAON GURGAON HARYANA GURGAON HARYANA 122001 GURGAONHARYANA 122001 | 1208870074582108 | 112.5 | 11-OCT-2029 | 2021-22 |

| HARPREET SINGH | TRILOCHAN SINGH | TRILOCHAN SINGH C/O TRILOCHAN SINGH PLOT NO 5 2ND FLOOR K6 1 VATIKA INDEPENDENT HOMES SEC 83 SECTOR 83 GURGAON GURGAON HARYANA INDIA 122004 GURGAONHARYANA 122004 | IN30051319582052 | 20 | 11-OCT-2029 | 2021-22 |

| VIJAY MEHROTRA | NOTAVAILABLE | NOTAVAILABLE S/OB.P.MEHROTRA 221SECTOR-56 S APARTMENT PLOT-78 SECTOR-56 GURGAON HARYANA 122011 GURGAONHARYANA 122011 | 1208160093571251 | 25 | 11-OCT-2029 | 2021-22 |

| CHETAN PARKASH | RAM NIWAS SHARMA | RAM NIWAS SHARMA H NO 19 SEC 6 KANINA MANDI MOHINDERGARH HARYANA INDIA 123027 MAHENDRAGARHHARYANA 123027 | IN30226912705308 | 7.5 | 11-OCT-2029 | 2021-22 |

| SUMIT YADAV | NOTAVAILABLE | NOTAVAILABLE C/OPRAHLAD SINGH YADAV REWARI HARYANA 123101 REWARIHARYANA 123101 | 1208160044358652 | 4.25 | 11-OCT-2029 | 2021-22 |

| RAVINDER KUMAR | SUBHASH CHAND | SUBHASH CHAND JALIAWAS 41 SUTHAN REWARI HARYANA HARYANA 123501 MAHENDRAGARHHARYANA 123501 | IN30070810699500 | 14.25 | 11-OCT-2029 | 2021-22 |

| AJAY KUMAR | GOPI RAM | GOPI RAM H.NO-114/22 VIKAS NAGAR ROHTAK HARYANA 124001 ROHTAKHARYANA 124001 | IN30236510438870 | 1250 | 11-OCT-2029 | 2021-22 |

| PREM LATA GOEL | DHARAM PAL GOEL | DHARAM PAL GOEL H NO 510/33 NAYA PARAO ROHTAK 124001 ROHTAKHARYANA 124001 | IN30177411513715 | 25 | 11-OCT-2029 | 2021-22 |

| SURINDER PAL POPLI | RAM PIARA MAL | RAM PIARA MAL HOUSE NO 304 SECTOR 14 ROHTAK ROHTAK HARYANA 124001 ROHTAKHARYANA 124001 | 1302590001103168 | 250 | 11-OCT-2029 | 2021-22 |

| SUMAN LATA GOYAL | S K GOYAL | S K GOYAL C/O S K GOYAL SHERPURA WALE BHADRA BAZAR SIRSA 125055 HISARHARYANA 125055 | 020742 | 250 | 11-OCT-2029 | 2021-22 |

| KANHIYA LAL JALAN | SANTI LAL JI | SANTI LAL JI C/O SANT LAL MAMERAWALA MAIN BAZAR PO ELLENABAD 125102 SIRSAHARYANA 125102 | 020223 | 750 | 11-OCT-2029 | 2021-22 |

| RENU GUPTA | SURESH KUMAR GARG | SURESH KUMAR GARG W/O SURESH KUMAR GARG H NO 1/826 ADARSH NAGAR NARWANA HRY 126116 JINDHARYANA 126116 | 020474 | 750 | 11-OCT-2029 | 2021-22 |

| SURESH KUMAR GARG | SARDHA RAM | SARDHA RAM H NO 1/826 ADARSH NAGAR NARWANA DISTT JIND HARYANA 126116 JINDHARYANA 126116 | 020475 | 500 | 11-OCT-2029 | 2021-22 |

| SUMIT | HARISH KUMAR | HARISH KUMAR H NO 64/142 JAWAHAR NAGAR BHIWANI HARYANA 127021 BHIWANIHARYANA 127021 | 1203320003237941 | 25 | 11-OCT-2029 | 2021-22 |

| PAWAN SHARMA | NOTAVAILABLE | NOTAVAILABLE WARD NUMBER 3 HARI NAGAR GHIK NEAR MASALA FACTORY BHIWANI HARYANA 127306 BHIWANIHARYANA 127306 | 1208160064834981 | 51.5 | 11-OCT-2029 | 2021-22 |

| PARDIP SINGH TANDON | MANJEET SINGH TANDON | MANJEET SINGH TANDON 236 MODEL TOWN SONEPAT HARYANA 131001 SONIPATHARYANA 131001 | 020209 | 250 | 11-OCT-2029 | 2021-22 |

| JYOTI GOYAL | BHARAT BHUSHAN | BHARAT BHUSHAN 722, SECTOR 12 SONEPAT HARYANA 131001 SONIPATHARYANA 131001 | 020894 | 2.5 | 11-OCT-2029 | 2021-22 |

| SHAVETA | INDERDEV THAKUR | INDERDEV THAKUR 7/660 KUMHAR GATE . SONEPAT HARYANA 131001 SONIPATHARYANA 131001 | 1204720011130499 | 2.5 | 11-OCT-2029 | 2021-22 |

| RAMAN SHARMA | NOTAVAILABLE | NOTAVAILABLE HOUSE NUMBER 61 KHATKAR WARD SONIPAT HARYANA 131028 SONIPATHARYANA 131028 | 1208160054498961 | 3 | 11-OCT-2029 | 2021-22 |

| SUMITRA DEVI | HARBANS LAL MALIK | HARBANS LAL MALIK 220 NEW RAMESH NAGAR . KARNAL 132001 KARNALHARYANA 132001 | IN30133019530514 | 500 | 11-OCT-2029 | 2021-22 |

| NIPUNJAINHUF | NOTAPPLICABLE | NOTAPPLICABLE 58/4 JAIN STREET . PANIPAT HARYANA 132103 PANIPATHARYANA 132103 | 1301760000023174 | 112 | 11-OCT-2029 | 2021-22 |

| SANDEEP SHARMA | NOTAVAILABLE | NOTAVAILABLE S/ORAM MEHAR SHARMA KARNAL HARYANA 132114 PANIPATHARYANA 132114 | 1208160098735870 | 12.5 | 11-OCT-2029 | 2021-22 |

| KRISHAN LAL KHURANA | HARNAM DAS KHURANA | HARNAM DAS KHURANA 29 A RAJA PARK CANTT NULL AMBALA HARYANA 133001 AMBALAHARYANA 133001 | IN30155721393034 | 75 | 11-OCT-2029 | 2021-22 |

| MOHAN LAL | RAM SHRI | RAM SHRI H NO 402 K BOARD WARD NO 2 AMBALA CANTT AMBALA HARYANA 133001 AMBALAHARYANA 133001 | IN30051314650449 | 50 | 11-OCT-2029 | 2021-22 |

| RITESH AGGARWAL | VINAY AGGARWAL | VINAY AGGARWAL H NO 27/1 WARD NO-6 JAIL LAND ROAD AMBALA CITY HARYANA 134001 AMBALAHARYANA 134001 | IN30114310471416 | 125 | 11-OCT-2029 | 2021-22 |

| HARVINDER SINGH | S WARYAM SINGH | S WARYAM SINGH H NO 8840/5 RAILWAY ROAD AMBALA CITY HARYANA 134002 AMBALAHARYANA 134002 | 020153 | 500 | 11-OCT-2029 | 2021-22 |

| SUMAN | NARESH KUMAR | NARESH KUMAR 362 URBAN ESTATE SECTOR 7 AMBALA CITY 134003 AMBALAHARYANA 134003 | 020609 | 750 | 11-OCT-2029 | 2021-22 |

| YUVRAJ CHOPRA | NOTAVAILABLE | NOTAVAILABLE H NO 113 SECTOR 25 PANCHKULA HARYANA 134116 PANCHKULAHARYANA 134116 | 1208160030284829 | 41.75 | 11-OCT-2029 | 2021-22 |

| GURMEET SINGH | AJMER SINGH | AJMER SINGH C/O NEEL AUTOMOBILES KANHIYA SAHIB CHOWK BY PASS ROAD, YAMUNA NAGAR HARYANA 135001 AMBALAHARYANA 135001 | 021061 | 750 | 11-OCT-2029 | 2021-22 |

| SURESH KUMAR GUPTA | SH BABOORAM GUPTA | SH BABOORAM GUPTA H.NO. 454 RAJA SAHIB STREET JAGADHRI HARYANA 135003 AMBALAHARYANA 135003 | IN30159010001768 | 50 | 11-OCT-2029 | 2021-22 |

| MOHINDER PAOL | KRISHAN LAL | KRISHAN LAL S/O SH KRISHAN LAL FRUIT WALA V&PO BILASPUR YAMUNA NAGAR HARYANA 135102 YAMUNA NAGARHARYANA 135102 | 020152 | 500 | 11-OCT-2029 | 2021-22 |

| SANDEEP PAL SINGH | PREM SINGH NANWA | PREM SINGH NANWA NO PLOT NO 12 WORK CENTER COLONY RAJPURA PUNJAB 140401 PATIALAPUNJAB 140401 | 1304140005793538 | 0.5 | 11-OCT-2029 | 2021-22 |

| RANJIT KUMAR BAWA | SUKHDEV CHAND | SUKHDEV CHAND S O SUKHDEV CHAND NEAR GURDWARA NAMDHARI MOGA PUNJAB 142039 MOGAPUNJAB 142039 | 1204470019548919 | 12.5 | 11-OCT-2029 | 2021-22 |

| GURSEWAK SINGH DHALIWAL | HARDYAL SINGH | HARDYAL SINGH S/O HARDIYAL SINGH KHANE KI PATTI KUSSA MONGA KUSSA PUNJAB MOGA PUNJAB 142039 MOGAPUNJAB 142039 | 1204470020590760 | 18.75 | 11-OCT-2029 | 2021-22 |

| KARAMJIT KAUR | JOGINDER SINGH | JOGINDER SINGH W/O RANVIR SINGH KHAI ROAD G MOGA PUNJAB 142055 MOGAPUNJAB 142055 | 1208880005113533 | 0.5 | 11-OCT-2029 | 2021-22 |

| KAMLESH GALHOTRA | SH JAGAN NATH | SH JAGAN NATH C/O MOHAN ROLLER FLOUR MILLS O/S GATE BHAGTANWALA AMRITSAR 143001 AMRITSARPUNJAB 143001 | IN30112716389240 | 625 | 11-OCT-2029 | 2021-22 |

| PANKAJ SHARMA | BANWARI LAL SHARMA | BANWARI LAL SHARMA H NO 211 NAGAR PALIKA W NO-3 GURDASPUR PUNJAB 143521 AMRITSARPUNJAB 143521 | 1203320001725794 | 50 | 11-OCT-2029 | 2021-22 |

| SURINDER PAL KAUR | DARSHAN SINGH VIRDI | DARSHAN SINGH VIRDI 101 RAMESHWAR COLONY JALANDHAR 144008 JALANDHARPUNJAB 144008 | IN30105510341722 | 0.25 | 11-OCT-2029 | 2021-22 |

| SUBHASH SACHDEVA | PRITAM DAS SACHDEVA | PRITAM DAS SACHDEVA 22-F GREEN PARK PALAHI ROAD PHAGWARA PUNJAB 144401 KAPURTHALAPUNJAB 144401 | 1204450000172144 | 50 | 11-OCT-2029 | 2021-22 |

| BABUL PRASAD | NOTAVAILABLE | NOTAVAILABLE H NO 11 HUNJAN PO PHULBAR DISTT TINSUKIA TINSUKIA ASSAM 144402 KAPURTHALAPUNJAB 144402 | 1203320006859579 | 50 | 11-OCT-2029 | 2021-22 |

| SANJEEV JAIN | SUBHASH KUMAR JAIN | SUBHASH KUMAR JAIN JUGAL KISHORE JAIN & SONS SARAF BAZAR PANSARIAN HOSHIARPUR 146001 HOSHIARPURPUNJAB 146001 | 020150 | 500 | 11-OCT-2029 | 2021-22 |

| RAJESH JAIN | SUBHASH KUMAR JAIN | SUBHASH KUMAR JAIN C/O JUGAL KISHORE & SONS BAZAR PANSARAIN HOSHIARPUR 146001 HOSHIARPURPUNJAB 146001 | 020892 | 250 | 11-OCT-2029 | 2021-22 |

| REKHA GERA | HARISH KUMAR GERA | HARISH KUMAR GERA HOUSE NO 386 TRIPURI TOWN PATIALA . 147001 PATIALAPUNJAB 147001 | IN30133017147270 | 7.5 | 11-OCT-2029 | 2021-22 |

| SAHIL GARG | BHIM SAIN | BHIM SAIN GALI NO 01 NEAR HANUMAN MURTI MODI MILL COLONY NABHA PATIALA PUNJAB 147201 PATIALAPUNJAB 147201 | 1208180040724555 | 5 | 11-OCT-2029 | 2021-22 |

| HARPREET KAUR | HARBHUPINDER SINGH | HARBHUPINDER SINGH H.NO 1064 A WARD NO 2 PART I NABHA PUNJAB 147201 PATIALAPUNJAB 147201 | IN30226911823540 | 12.5 | 11-OCT-2029 | 2021-22 |

| DEVINDER SINGH | HARNAK SINGH | HARNAK SINGH SO HARNEK SINGH STREET NUMBER5 DASH MESH NAGAR NEAR CHEFHOTEL SANGRUR PUNJAB 148001 SANGRURPUNJAB 148001 | 1208870021195939 | 30 | 11-OCT-2029 | 2021-22 |

| ANAND VARDHAN | HARI KRISHAN | HARI KRISHAN 33 WARD NUMBER-5 GAMRI ROAD DIRBA SANGRUR PUNJAB 148035 SANGRURPUNJAB 148035 | 1203320061259285 | 12.5 | 11-OCT-2029 | 2021-22 |

| SONI GARG | SADHU RAM GARG | SADHU RAM GARG HOUSE NO 9068 SITA BHAWAN KALIA STREET NEW BUS STAND BATHINDA PUNJAB 151001 BATHINDAPUNJAB 151001 | IN30114310609658 | 160 | 11-OCT-2029 | 2021-22 |

| NARESH GAURI | BALKISHAN | BALKISHAN C/O SHIV KUMAR & CO GAWRI MARKET MUKTSAR 152026 FIROZPURPUNJAB 152026 | 020607 | 750 | 11-OCT-2029 | 2021-22 |

| VIRENDER SHARMA | MURARI LAL SHARMA | MURARI LAL SHARMA 3684/5 NAI ABADI ABOHAR 152116 MUKTSARPUNJAB 152116 | 020210 | 500 | 11-OCT-2029 | 2021-22 |

| TRIPTA KALRA | KEWAL KRISHAN KALRA | KEWAL KRISHAN KALRA B III 1225 GANDHI NAGAR FAZILKA DISTT FEROZEPUR PUNJAB 152123 MUKTSARPUNJAB 152123 | 020207 | 500 | 11-OCT-2029 | 2021-22 |

| RAKESH KUMAR BANSAL | JAGDISH PRASHAD BANSAL | JAGDISH PRASHAD BANSAL A 151 JHAKRI TEH RAMPUR DISTT SHIMLA H.P. 172001 KULLUHIMACHAL PRADESH 172001 | IN30133020839076 | 12.5 | 11-OCT-2029 | 2021-22 |

| VIJAY SHANKAR SINGH | RAM KUMAR SINGH | RAM KUMAR SINGH J P ASSOCIATE LTD SHOLTU PO TAPRI TEH NICHAR KINNAUR 172104 KINNAURHIMACHAL PRADESH 172104 | IN30177415130144 | 0.25 | 11-OCT-2029 | 2021-22 |

| SUNEEL KUMAR | DUNI CHAND | DUNI CHAND MEHRE VPO MEHRE TEHSIL BARSAR DISTRICT HAMIRPUR HAMIRPUR(HP) HIMACHAL PRADESH 174305 UNAHIMACHAL PRADESH 174305 | 1208180008890692 | 40 | 11-OCT-2029 | 2021-22 |

| YASHPAL SHARMA | KASHMIR CHAND | KASHMIR CHAND H NO 3 1 THANA VILL THANA PS BALH AT RATI TEH SADAR MANDI HIMACHAL PRADESH 175008 MANDIHIMACHAL PRADESH 175008 | 1204720002432113 | 145 | 11-OCT-2029 | 2021-22 |

| SADHU SINGH | PISHORI LAL | PISHORI LAL VPO AUT PO AUT DISTT-MANDI MANDI HIMACHAL PRADESH 175121 KULLUHIMACHAL PRADESH 175121 | 1202420100105979 | 25 | 11-OCT-2029 | 2021-22 |

| ABHISHEK CHAUDHARY | RAJINDER KUMAR | RAJINDER KUMAR V P O KACHHIARI TEH KANGRA KACHHIARI KANGRA HIMACHAL PRADESH 176001 KANGRAHIMACHAL PRADESH 176001 | 1203320072466461 | 2.5 | 11-OCT-2029 | 2021-22 |

| PARV SHARMA | CHAMANLAL SHARMA | CHAMANLAL SHARMA VPO RAJOL TEH SHAHPUR DISTT KANGRA HIMACHAL PRADESH 176208 KANGRAHIMACHAL PRADESH 176208 | IN30089610330856 | 4.25 | 11-OCT-2029 | 2021-22 |

| RITU THAKUR | KAMAL THAKUR | KAMAL THAKUR W/O KAMAR JEET AND C/O ASHOK THAKUR PRATAP NAGAR V.P.O AMB DISTT-UNA HIMACHAL PRADESH 177203 UNAHIMACHAL PRADESH 177203 | IN30167010266281 | 12.5 | 11-OCT-2029 | 2021-22 |

| VINAY SAMOTRA | BODH RAJ SHARMA | BODH RAJ SHARMA F-34 BEHIND A-G COLONY SHIV NAGAR JAMMU J&K 180001 JAMMUJAMMU AND KASHMIR 180001 | 020611 | 1250 | 11-OCT-2029 | 2021-22 |

| GANESH SINGH | SHANTI SINGH | SHANTI SINGH WARD NO - 4 NEAR FOOD AND SUPPLIES UDHAMPUR JAMMU AND KASHMIR 182101 UDHAMPURJAMMU AND KASHMIR 182101 | 1203000000545482 | 125 | 11-OCT-2029 | 2021-22 |

| ASHFAQ AHMAD ZAROO | WALI MOHMMAD ZAROO | WALI MOHMMAD ZAROO SHERWANI COLONEY KHAWAJABAGH BARAMULLA BARAMULLA JAMMU AND KASHMIR 193101 BARAMULLAJAMMU AND KASHMIR 193101 | 1203350001459138 | 10 | 11-OCT-2029 | 2021-22 |

| MOHD YASEEN MIR | GHULAM MOHD MIR | GHULAM MOHD MIR S/O GHULAM MOHD MIR GANTMLLA BARAMULLA BARAMULLA JAMMU AND KASHMIR 193125 BARAMULLAJAMMU AND KASHMIR 193125 | 1203350001762312 | 7.5 | 11-OCT-2029 | 2021-22 |

| SUSHIL KUMAR GUPTA | MAHESH CHAND GUPTA | MAHESH CHAND GUPTA 14 CHANDER PURI GHAZIABAD U P 201001 GHAZIABADUTTAR PRADESH | 020808 | 750 | 11-OCT-2029 | 2021-22 |

| RAJNI GUPTA | V G GUPTA | V G GUPTA KC-64 KAVI NAGAR GHAZIABAD 201002 GHAZIABADUTTAR PRADESH | 020175 | 500 | 11-OCT-2029 | 2021-22 |

| KRISHNA GROVER | ASHOK GROVER | ASHOK GROVER C/O DR ASHOK GROVER NASRAT PURA JAIN TEMPAL GHAZIABAD 201009 GHAZIABADUTTAR PRADESH | 020184 | 750 | 11-OCT-2029 | 2021-22 |

| ASHOK GROVER | HEM RAJ | HEM RAJ NASRAT PURA JAIN TEMPLE GHAZIABAD 201009 GHAZIABADUTTAR PRADESH | 020220 | 750 | 11-OCT-2029 | 2021-22 |

| RAKHI GOEL | VISHAL GOEL | VISHAL GOEL D 138 SECTOR 9 NEW VIJAY NAGAR UTTAR PRADESH GHAZIABAD 201009 GHAZIABADUTTAR PRADESH | IN30011811475747 | 50 | 11-OCT-2029 | 2021-22 |

| SARATH B | K BHASKARAN | K BHASKARAN 17E 626 KONARK ENCLAVE VASUNDHARA GHAZIABAD UTTAR PRADESH 201012 GHAZIABADUTTAR PRADESH | 1208250024540917 | 5 | 11-OCT-2029 | 2021-22 |

| RITU AGARWAL | MUKAT LAL AGARWAL | MUKAT LAL AGARWAL D 50 B SECTOR 26 NOIDA 201301 GAUTAM BUDDHA NAGARUTTAR PRADESH | 020194 | 250 | 11-OCT-2029 | 2021-22 |

| SUNIL KUMAR SHARMA | MURARILAL SHARMA | MURARILAL SHARMA G- 52, SECTOR- 20 NOIDA 201301 GAUTAM BUDDHA NAGARUTTAR PRADESH | 021011 | 0.25 | 11-OCT-2029 | 2021-22 |

| RITA DUBEY | ARUN KUMAR DUBEY | ARUN KUMAR DUBEY FLAT NO. 10 PLOT NO. E 10/A MILLENIUM APARTMENT SEC-61 NOIDA(U.P.) 201301 GAUTAM BUDDHA NAGARUTTAR PRADESH | IN30223610249094 | 250 | 11-OCT-2029 | 2021-22 |

| SAURABH DIXIT | MAHESH CHANDRA DIXIT | MAHESH CHANDRA DIXIT 1/1400A ETAH CHUNGI VIKAS NAGA ALIGARH UTTAR PRADESH 202001 ALIGARHUTTAR PRADESH | 1208880008559794 | 5 | 11-OCT-2029 | 2021-22 |

| PREM CHANDRA SHARMA | PARASHU RAM SHARMA | PARASHU RAM SHARMA H.NO.-5/10 PRITHVIRAJ NAGAR BEHIND BLUE BIRD SCHOOL BANNA DEVI G.T. ROAD ALIGARH UTTAR PRADESH 202001 ALIGARHUTTAR PRADESH | IN30236510738818 | 25 | 11-OCT-2029 | 2021-22 |

| KRISHAN KUMAR SINGHAL | CHANDRA PRAKASH SINGHAL | CHANDRA PRAKASH SINGHAL STREET NAV GANJ SHIKARPUR BULANDSHAHR SHIKARPUR UTTAR PRADESH 202395 BULANDSHAHRUTTAR PRADESH | 1202060000010365 | 250 | 11-OCT-2029 | 2021-22 |

| KUSUM BAJPAI | VED PRAKASH BAJPAI | VED PRAKASH BAJPAI 60/39 CANAL ROAD KANPUR 208001 KANPUR DEHATUTTAR PRADESH | 020565 | 750 | 11-OCT-2029 | 2021-22 |

| ALKESH BAJPAI | RAJESH KUMAR BAJPAI | RAJESH KUMAR BAJPAI HOUSE NO. 128/247 K BLOCK KIDWAI NAGAR KANPUR UTTAR PRADESH 208011 KANPUR DEHATUTTAR PRADESH | 1201910101469801 | 12.75 | 11-OCT-2029 | 2021-22 |

| NAVAL KISHORE | RAM DAS GUPTA | RAM DAS GUPTA C/O GUPTA JEWELLERS SHOP NO 7 MISRA MARKET SISAMAU KANPUR 208012 KANPUR DEHATUTTAR PRADESH | 020564 | 500 | 11-OCT-2029 | 2021-22 |

| RAM BACHAN VERMA | RAMCHANDRA VERMA | RAMCHANDRA VERMA 127/520 A-1 W BLOCK KESHAV NAGAR JUHI COLONY KANPUR NAGAR KANPUR UTTAR PRADESH 208014 KANPUR DEHATUTTAR PRADESH | 1203840000754675 | 175 | 11-OCT-2029 | 2021-22 |

| KRISHNA MOHAN GUPTA | BUDDHI LAL GUPTA | BUDDHI LAL GUPTA L.I.G 138 BARRA 2 KANPUR 208027 KANPUR DEHATUTTAR PRADESH | IN30055610251150 | 25 | 11-OCT-2029 | 2021-22 |

| JAYA GUPTA | SHAILENDRA KUMAR | SHAILENDRA KUMAR RAJIVE AGENCIES OPP KOTWALI BANDA UP DISTT BANDA 210001 BANDAUTTAR PRADESH | 020568 | 750 | 11-OCT-2029 | 2021-22 |

| LIAQUAT ALI | SHARAFAT ALI | SHARAFAT ALI 29 BAKHTIARY OLD KATRA TURKANA ALLAHABAD 211002 ALLAHABADUTTAR PRADESH | 020046 | 750 | 11-OCT-2029 | 2021-22 |

| BRAJ PRAKASH AGARWAL | GYAN PRAKASH GANGAL | GYAN PRAKASH GANGAL 644/508 MUMFORD GANJ GYAN ROAD ALLAHABAD 211002 ALLAHABADUTTAR PRADESH | 020048 | 750 | 11-OCT-2029 | 2021-22 |

| NIRAJ KUMAR | DR JS SRIVASTAVA | DR JS SRIVASTAVA 41 B TAGORE TOWN ALLAHABAD 211002 ALLAHABADUTTAR PRADESH | IN30133017472950 | 32.5 | 11-OCT-2029 | 2021-22 |

| RAMJEE | SAHU SETH | SAHU SETH ELECT SECTION 29 WING AFBAMRAULI ALLAHABAD UTTAR PRADESH 211012 ALLAHABADUTTAR PRADESH | IN30039416997196 | 1.5 | 11-OCT-2029 | 2021-22 |

| SAROJ AGRAWAL | RAM PRASAD AGRAWAL | RAM PRASAD AGRAWAL C K-52/7 RAJA DARWAJA VARANASI 221001 CHANDAULIUTTAR PRADESH | 020637 | 500 | 11-OCT-2029 | 2021-22 |

| NEERAJ GUPTA | RAMLAL GUPTA | RAMLAL GUPTA H NO 8 4 20 A NEW COLONY JHARKHANDI FAIZABAD UTTAR PRADESH 224001 FAIZABADUTTAR PRADESH | IN30307710366140 | 125 | 11-OCT-2029 | 2021-22 |

| VIVEK AGARWAL | TRILOKI NATH AGARWAL | TRILOKI NATH AGARWAL 311/22 KAMLA NEHRU MARG CHOWK LUCKNOW 226003 LUCKNOWUTTAR PRADESH | 020576 | 750 | 11-OCT-2029 | 2021-22 |

| RAVI BALI | RAI RAJESHWAR BALI | RAI RAJESHWAR BALI C-9/1 RIVER BANK COLONY LUCKNOW 226018 LUCKNOWUTTAR PRADESH | 020579 | 750 | 11-OCT-2029 | 2021-22 |

| AKSHAY KUMAR | MARAM JUNGSINGH BAHADUR | MARAM JUNGSINGH BAHADUR B 1 / 147 SECTOR G ALIGANJ LUCKNOW UTTAR PRADESH 226020 LUCKNOWUTTAR PRADESH | 1204470002361141 | 7.5 | 11-OCT-2029 | 2021-22 |

| PREM SHANKER DUBEY | BRIJ NATH DUBEY | BRIJ NATH DUBEY VILLAGE & POST DOMRI DISTRICT MIRZAPUR U P 231305 MIRZAPURUTTAR PRADESH | 020045 | 750 | 11-OCT-2029 | 2021-22 |

| VIKESH KUMAR SINGH | RAKESH KUMAR SINGH | RAKESH KUMAR SINGH M NO 282 CHUNAR MIRZAPUR SAHASPURA NARAYANPUR . MIRZAPUR UTTAR PRADESH 231305 MIRZAPURUTTAR PRADESH | 1208870019302345 | 50 | 11-OCT-2029 | 2021-22 |

| RAM SUMIRNI DEVI | RAMESHWAR PRASAD GUPTA | RAMESHWAR PRASAD GUPTA 435/4 BEHRA SAUDAGAR PURVI BHAG-6 HARDOI UTTAR PRADESH 241001 HARDOIUTTAR PRADESH | 1203980000075206 | 37.5 | 11-OCT-2029 | 2021-22 |

| HIMANSHU GUPTA | DINESH KUMAR GUPTA | DINESH KUMAR GUPTA MOH BARAHPATTAR TILHAR SHAHJAHANPUR UTTAR PRADESH 242307 SHAHJAHANPURUTTAR PRADESH | IN30051321776625 | 0.25 | 11-OCT-2029 | 2021-22 |

| RAJEEV KUMAR GUPTA | RAMESH CHANDRA GUPTA | RAMESH CHANDRA GUPTA D-92/9 JAGDISH VIHAR RAJENDRA NAGAR BAREILLY 243122 BAREILLYUTTAR PRADESH | IN30118620067984 | 62.5 | 11-OCT-2029 | 2021-22 |

| SHIPRA RASTOGI | SH NEETAL RASTOGI | SH NEETAL RASTOGI RAM NATH COLONEY . BADAUN U.P. 243601 BUDAUNUTTAR PRADESH | 1206120000275631 | 375 | 11-OCT-2029 | 2021-22 |

| ABHINANDAN KUMAR JAIN | HANS KUMAR JAIN | HANS KUMAR JAIN 212-NA-11 LAZPAT NAGAR MORADABAD 244001 MORADABADUTTAR PRADESH | IN30282210016804 | 150 | 11-OCT-2029 | 2021-22 |

| SUSHAMA AGARWAL | GIRI RAJ KISHOR | GIRI RAJ KISHOR CROSS WHEELS AUTO LTD KANTH ROAD MORADABAD UP 244001 MORADABADUTTAR PRADESH | 1204180000071348 | 1250 | 11-OCT-2029 | 2021-22 |

| NEERAJ GUPTA | RAM DAS | RAM DAS C/O GUPTA SWEETS CHAURAHA BAZAR KOT AMROHA DIST MORADABAD UP 244221 JYOTIBA PHULE NAGARUTTAR PRADESH | 020219 | 1000 | 11-OCT-2029 | 2021-22 |

| JAIDEEP SHARMA | OM PRAKASH SHARMA | OM PRAKASH SHARMA MOH.CHOWK 2 H.N. 190 B.B.NAGAR BULANDSHAHR 245402 BULANDSHAHRUTTAR PRADESH | IN30070810516166 | 337.5 | 11-OCT-2029 | 2021-22 |

| PARITOSH | KARANVIR SINGH | KARANVIR SINGH H.NO-31 VILLAGE NATHUGARHI DEVANAGAR DEVALI GULAWATHI BULANDSHAHAR 245408 BULANDSHAHRUTTAR PRADESH | IN30070810378025 | 250 | 11-OCT-2029 | 2021-22 |

| PRAKASH CHAND | RAM LAL | RAM LAL MORE GANJ SAHARANPUR 247001 SAHARANPURUTTAR PRADESH | IN30177416407443 | 94.75 | 11-OCT-2029 | 2021-22 |

| AJAY BATRA | JIVAN LAL BATRA | JIVAN LAL BATRA 12 SATI MOHALLA NEAR MOTI MASJID ROORKEE 247667 HARIDWARUTTARAKHAND | 020211 | 1250 | 11-OCT-2029 | 2021-22 |

| ANKIT KAPOOR | PAWAN KAPOOR | PAWAN KAPOOR 22/2 SECTOR 2 SHASTRI NAGAR MEERUT UTTAR PRADESH 250001 MEERUTUTTAR PRADESH | 1204470006471471 | 20 | 11-OCT-2029 | 2021-22 |

| ARUN KUMAR TYAGI | KRISHAN DUTT TYAGI | KRISHAN DUTT TYAGI 273 BRAHMPURI MUZAFFAR NAGAR 251001 MUZAFFARNAGARUTTAR PRADESH | IN30177410905410 | 2.75 | 11-OCT-2029 | 2021-22 |

| LAL BAHADUR JAIN | I S JAIN | I S JAIN 288 PATEL NAGAR NEAR TELEPHONE QUARTER MUZAFFAR NAGAR MUZAFFARNAGAR UTTAR PRADESH 251001 MUZAFFARNAGARUTTAR PRADESH | 1203350001403496 | 327.5 | 11-OCT-2029 | 2021-22 |

| DALIP KUMAR | RAM PAL SARAN | RAM PAL SARAN 80 DORILAL DAIRY WALA PILIBHIT U P 262001 PILIBHITUTTAR PRADESH | 020167 | 500 | 11-OCT-2029 | 2021-22 |

| DEEPAK KUMAR | SATISH CHANDRA | SATISH CHANDRA RADHAYSHAYAM SATISH CHANDRA SARAFA GALI KESARI SINGH PILIBHIT UP 262001 PILIBHITUTTAR PRADESH | 020168 | 250 | 11-OCT-2029 | 2021-22 |

| HARI SINGH | SITARAM | SITARAM 165 E BANUSA UDHAM SINGH NAGAR NAINITAL UTTARAKHAND 262308 PILIBHITUTTAR PRADESH | 1203320063050870 | 10.5 | 11-OCT-2029 | 2021-22 |

| NITISH BINWAL | UMAKANT BINWAL | UMAKANT BINWAL SRI. JAGNATH TRADERS KUSUM KHERA CHAURAHA HALDWANI UTTARAKHAND 263139 NAINITALUTTARAKHAND | 1201090009901005 | 18.75 | 11-OCT-2029 | 2021-22 |

| SUMANTA KUMAR LODHA | BHARAT KUMAR LODHA | BHARAT KUMAR LODHA GAYATRI COLONY MALLI BAMORI HALDWANI UTTARAKHAND 263139 NAINITALUTTARAKHAND | 1202890001072514 | 250 | 11-OCT-2029 | 2021-22 |

| VIJAY SHANKER TEWARI | SALIG RAM TEWARI | SALIG RAM TEWARI 114 STATION ROAD GONDA UTTAR PRADESH 271001 GONDAUTTAR PRADESH | IN30051314937942 | 62.5 | 11-OCT-2029 | 2021-22 |

| SHAZIA RAHMAN WARSI | MOHAMMAD ALI WARSI | MOHAMMAD ALI WARSI MOHALLA TURKAHIYAN GANDHI NAGAR BASTI UP 272001 BASTIUTTAR PRADESH | 1204180000062905 | 75 | 11-OCT-2029 | 2021-22 |

| SANJEEV KUMAR SHARMA | RAM BABU SHARMA | RAM BABU SHARMA 373 CHUNA KANKAR MATHURA UP 281001 MATHURAUTTAR PRADESH | 020222 | 750 | 11-OCT-2029 | 2021-22 |

| BHEEK CHAND GUPTA | RUPACHANDRA GUPTA | RUPACHANDRA GUPTA BHEEK CHAND GUPTA BARTAN WALA RETIYA BAZAR VRINDAVAN UTTAR PRADESH 281121 HATHRASUTTAR PRADESH | 1301440000576751 | 12.5 | 11-OCT-2029 | 2021-22 |

| RAJESH KUMAR AGARWAL | RAMJILAL AGARWAL | RAMJILAL AGARWAL AGARWAL DALL MILL 19/88 PEER KALYANI MOTI LAL NEHRU ROAD AGRA 282004 AGRAUTTAR PRADESH | 020027 | 1000 | 11-OCT-2029 | 2021-22 |

| MANJINDER SINGH | NOTAVAILABLE | NOTAVAILABLE MMIG-3 GURU TEG BAHADUR COLONY GURU KA TAAL AGRA UTTAR PRADESH 282007 AGRAUTTAR PRADESH | 1208160077613620 | 15.75 | 11-OCT-2029 | 2021-22 |

| TRISHLA DEVI JAIN | JASBIR PRASAD JAIN | JASBIR PRASAD JAIN JINENDRA BHAWAN TUNDLA UP 283204 AGRAUTTAR PRADESH | 020021 | 500 | 11-OCT-2029 | 2021-22 |

| RAMESH KUMAR SHRIVASTAVA | GURUCHARAN LAL SHRIVASTAVA | GURUCHARAN LAL SHRIVASTAVA SUBHASH NAGAR BHEL JHANSI 284001 JHANSIUTTAR PRADESH | IN30039416712959 | 875 | 11-OCT-2029 | 2021-22 |

| ANJANA KAPOOR | VIJAY KUMAR KAPOOR | VIJAY KUMAR KAPOOR 80/9 SADHURAM COMPOUND CIVIL LINES JHANSI 284001 JHANSIUTTAR PRADESH | IN30051310237272 | 12.5 | 11-OCT-2029 | 2021-22 |

| SANJAY RAJPOOT | PARMESHWARI DAYAL | PARMESHWARI DAYAL B-29 AVAS VIKAS COLONY SHIVPURI ROAD SIPRI BAZAR JHANSI U. P. 284003 JHANSIUTTAR PRADESH | 1202890000827285 | 28.25 | 11-OCT-2029 | 2021-22 |

| SUNIL BILKHA | G R BILKHA | G R BILKHA 12 BILKHA BHAWAN BEHIND M H NAYABAS ALWAR 301001 ALWARRAJASTHAN 301001 | 020496 | 250 | 11-OCT-2029 | 2021-22 |

| RINKI PRADHAN | BRIJENDRA PRADHAN | BRIJENDRA PRADHAN 67 ARYA NAGAR SCH NO 1 ALWAR RAJ 301001 ALWARRAJASTHAN 301001 | 020499 | 750 | 11-OCT-2029 | 2021-22 |

| MENAKSHI PRADHAN | BRIJENDRA PRADHAN | BRIJENDRA PRADHAN 67 ARYA NAGAR SCH NO 1 ALWAR RAJ 301001 ALWARRAJASTHAN 301001 | 020500 | 250 | 11-OCT-2029 | 2021-22 |

| KAMLESH SHRMA | NOTAVAILABLE | NOTAVAILABLE 31 ALKAPUR ALWAR RAJ 301001 ALWARRAJASTHAN 301001 | 020502 | 500 | 11-OCT-2029 | 2021-22 |

| KAUSHAL KUMAR | NOTAVAILABLE | NOTAVAILABLE S/O: NARENDRA KUMAR ALWAR RAJASTHAN 301706 ALWARRAJASTHAN 301706 | 1208160070325686 | 50 | 11-OCT-2029 | 2021-22 |

| DINESH KUMAR JAIN | MOHAN LAL JAIN | MOHAN LAL JAIN 337 AKRON KA RASTA KISHAN POLE BAZAR JAIPUR 302001 JAIPURRAJASTHAN 302001 | 020004 | 250 | 11-OCT-2029 | 2021-22 |

| KAMAL KUMAR KABRA | GOPAL KABRA | GOPAL KABRA KABRA INVESTMENTS ANAJ MANDI CHAND POLE JAIPUR 302001 JAIPURRAJASTHAN 302001 | 020443 | 1250 | 11-OCT-2029 | 2021-22 |

| SHASHI MOHAN SHARMA | B M SHARMA | B M SHARMA SHRI RANG BHAWAN SUBHASH MARG C SCHEME JAIPUR 302001 JAIPURRAJASTHAN 302001 | 020773 | 250 | 11-OCT-2029 | 2021-22 |

| MANJU BALA | KANWAR SINGH | KANWAR SINGH 37 DR. COLONY AJMER ROAD WARD NO.- 3 JAIPUR 302001 JAIPURRAJASTHAN 302001 | IN30210510457268 | 150 | 11-OCT-2029 | 2021-22 |

| NARENDRA KUMAR BHALA | SH SITARAM BHALA | SH SITARAM BHALA D-38 NEW ANAJ MANDI CHANDPOLE BAZAR JAIPUR RAJASTHAN 302001 JAIPURRAJASTHAN 302001 | 1201410100016145 | 50 | 11-OCT-2029 | 2021-22 |

| KRISHAN KUMAR KHUNTETA | MURLIDHER KHUNTETA | MURLIDHER KHUNTETA 262 GOVIND NAGAR (E) AMER ROAD JAIPUR 302002 JAIPURRAJASTHAN 302002 | IN30160410169315 | 24.75 | 11-OCT-2029 | 2021-22 |

| UZMA UROOJ | SYED IRSHADALI NAQVI | SYED IRSHADALI NAQVI 315/4 H A R YASIYAN PUBLIC SCHOOL KE PASS CHARDARAVAJABA WARD NO-50 JAIPUR RAJASTHAN 302002 JAIPURRAJASTHAN 302002 | 1204470004173319 | 3 | 11-OCT-2029 | 2021-22 |

| RAMESH CHANDRA LAKHWANI | PARS RAM LAKHWANI | PARS RAM LAKHWANI A-28 PITRICHHAYA JAIPUR RAJASTHAN 302003 JAIPURRAJASTHAN 302003 | 1204470003943387 | 2.5 | 11-OCT-2029 | 2021-22 |

| MURARI LAL GUPTA | B P GUPTA | B P GUPTA GUPTA HOMOEO CLINIC GALI NO 1 RAJAPARK JAIPUR RAJASTHAN 302004 JAIPURRAJASTHAN 302004 | 020309 | 500 | 11-OCT-2029 | 2021-22 |

| SHASHI GUPTA | M L GUPTA | M L GUPTA GUPTA HOMOEO CLINIC GALI NO 1 RAJAPARK JAIPUR 302004 JAIPURRAJASTHAN 302004 | 020310 | 500 | 11-OCT-2029 | 2021-22 |

| NEELIMA SRIVASTAVA | NARENDRA KUMAR SRIVASTAVA | NARENDRA KUMAR SRIVASTAVA 9B, VISHNU COLONY LAXMI NAGAR, OPP ESI HOSPITAL SADALA JAIPUR (RAJ) 302006 JAIPURRAJASTHAN 302006 | 020139 | 750 | 11-OCT-2029 | 2021-22 |

| AJAY SHARMA | S SHARMA | S SHARMA E 816 JYOTI SADAN VAISHALI NAGAR JAIPUR 302012 JAIPURRAJASTHAN 302012 | 020758 | 250 | 11-OCT-2029 | 2021-22 |

| KAMLESH KHANDELWAL | SURENDRA KHANDELWAL | SURENDRA KHANDELWAL E-809 NEAR PARTAP NURSARY LAL KOTHI JAIPUR 302015 JAIPURRAJASTHAN 302015 | 020295 | 250 | 11-OCT-2029 | 2021-22 |

| ABHA RASTOGI | TEJPAL RASTOGI | TEJPAL RASTOGI F-127 F TYPE GANDHI NAGAR WARD NO-45 JAIPUR 302015 JAIPURRAJASTHAN 302015 | IN30305210125953 | 2.25 | 11-OCT-2029 | 2021-22 |

| AMIT JAIN | PRAKASH CHAND JAIN | PRAKASH CHAND JAIN SB 107 C SETHI HOUSE LAL KOTHI TONK RAOD JAIPUR RAJASTHAN 302015 JAIPURRAJASTHAN 302015 | 1203410000084153 | 562.5 | 11-OCT-2029 | 2021-22 |

| PURSHOTAM DAS MALPANI | LAXMI MALPANI | LAXMI MALPANI B-15 VASUDEV MARG SUBHASH NAGAR SHOPPING CENTER JAIPUR 302016 JAIPURRAJASTHAN 302016 | 020438 | 250 | 11-OCT-2029 | 2021-22 |

| MAHENDRA KUMAR PODDAR | RATAN LAL PODDAR | RATAN LAL PODDAR S N BERIWAL & CO 31/32 SHASTRI NAGAR SHOPPING CENTRE NEAR PITTAL FACTORY JAIPUR 302016 JAIPURRAJASTHAN 302016 | 020447 | 500 | 11-OCT-2029 | 2021-22 |

| SUMITRA SHARMA | M C SHARMA | M C SHARMA F 87 MAJOR SHAITAN SINGH COLONY SHASTRI NAGAR JAIPUR 302016 JAIPURRAJASTHAN 302016 | 020759 | 250 | 11-OCT-2029 | 2021-22 |

| VANILA JAIN | KRANTI KUMAR VAIDYA | KRANTI KUMAR VAIDYA 415 MALVIYA NAGAR HOUSING BOARD JAIPUR 302017 JAIPURRAJASTHAN 302017 | IN30220110929955 | 12.5 | 11-OCT-2029 | 2021-22 |

| ANNU MATHUR | GHAN SHYAM MATHUR | GHAN SHYAM MATHUR 42 SHIVRAM COLONY NR GOLDEN DOMES JAGATPURA JAIPUR RAJASTHAN 302017 JAIPURRAJASTHAN 302017 | IN30051321255934 | 3.75 | 11-OCT-2029 | 2021-22 |

| GOVIND | M K GUPTA | M K GUPTA S-135 MAHAVIR NAGAR TONK ROAD JAIPUR 302018 JAIPURRAJASTHAN 302018 | 020311 | 500 | 11-OCT-2029 | 2021-22 |

| RAJANI MAHARWAL | AJAY MAHARWAL | AJAY MAHARWAL 651 SURYA NAGAR GOPALPURA BYE PASS JAIPUR JAIPUR RAJASTHAN 302018 JAIPURRAJASTHAN 302018 | 1204470001454446 | 53.5 | 11-OCT-2029 | 2021-22 |

| USHA SONI | JITENDRA KUMAR SONI | JITENDRA KUMAR SONI E-268 VAISHALI NAGAR JAIPUR 302019 JAIPURRAJASTHAN 302019 | 020562 | 750 | 11-OCT-2029 | 2021-22 |

| UMESH CHANDRA SHARMA | R SHARMA | R SHARMA AB 410 411 KINGS ROAD NIRMAN NAGAR AJMER ROAD JAIPUR 302019 JAIPURRAJASTHAN 302019 | 020812 | 500 | 11-OCT-2029 | 2021-22 |

| BEENA CHATURVEDI | D K CHATURVEDI | D K CHATURVEDI 55/131 RAJAT PATH MANSROVER JAIPUR 302020 JAIPURRAJASTHAN 302020 | 020439 | 750 | 11-OCT-2029 | 2021-22 |

| LAXMIKANT JAJODIA | RAM CHANDRA JAJODIA | RAM CHANDRA JAJODIA 7/2 VIDHYADHAR NAGAR JAIPUR 302023 JAIPURRAJASTHAN 302023 | 020316 | 500 | 11-OCT-2029 | 2021-22 |

| ABHAY KUMAR JHA | KAILASH PRASAD JHA | KAILASH PRASAD JHA 138 RAGHUNATHPURI I SHEOPUR ROAD PRATAP NAGAR SANGANER . JAIPUR RAJASTHAN 302024 JAIPURRAJASTHAN 302024 | 1204720010083420 | 130.25 | 11-OCT-2029 | 2021-22 |

| MANAK CHAND JAIN | BAJMAL JAIN | BAJMAL JAIN 85-86 FLAT NO 202 FLOR - 02 SHYAM VIHAR BEHIND CHORDIYA P SANGANER JAIPUR JAIPUR RAJASTHAN 302029 JAIPURRAJASTHAN 302029 | 1203410000190584 | 25 | 11-OCT-2029 | 2021-22 |

| PRIYANKA JAIN | RAJ MAL JAIN | RAJ MAL JAIN W/O NILESH JAIN 141 SURYA NAGAR DURGA PURA SANGANER BAZAR JAIPUR RAJASTHAN 302029 JAIPURRAJASTHAN 302029 | 1201770100394046 | 954.5 | 11-OCT-2029 | 2021-22 |

| SHYAM SUNDER GROVER | NOTAVAILABLE | NOTAVAILABLE 2/183 JAIPUR RAJASTHAN 302039 JAIPURRAJASTHAN 302039 | 1208160059059993 | 2.5 | 11-OCT-2029 | 2021-22 |

| PANKAJ KUMAR RAWAT | H N GUPTA | H N GUPTA C/O SUNIL TRADERS KHADI BHANDAR ROAD, DAUSA RAJASTHAN 303303 JAIPURRAJASTHAN 303303 | 020757 | 250 | 11-OCT-2029 | 2021-22 |

| PREM DEVI CHOUDHARY | NARAYAN LAL CHOUDHARY | NARAYAN LAL CHOUDHARY W/O GOPAL LAL CHOUDHARY SAMOTA KA BASS KACHRODA VIA PHULERA JAIPUR 303338 JAIPURRAJASTHAN 303338 | IN30136410013512 | 20 | 11-OCT-2029 | 2021-22 |

| RAJ KUMAR MEENA | NOTAVAILABLE | NOTAVAILABLE PYARIWAS NANGAL RAJAWATAN DAUS DAUSA RAJASTHAN 303505 DAUSARAJASTHAN 303505 | 1208160077642301 | 118.75 | 11-OCT-2029 | 2021-22 |

| SHIV KUMAR GHIYA | HARI NARAYAN GHIYA | HARI NARAYAN GHIYA PLOT NO. 18 KRISHNA COLONY NEAR CHANDA TAKIJ TONK ROAD NEWAI (TONK) 304021 TONKRAJASTHAN 304021 | IN30011830045912 | 62.5 | 11-OCT-2029 | 2021-22 |

| SANDEEP BARJATYA | BABU LAL JAIN | BABU LAL JAIN 98 PIR BABA K PICHHE VARD NO - 16 DEOLI RAJASTHAN 304804 TONKRAJASTHAN 304804 | 1201910100760901 | 10 | 11-OCT-2029 | 2021-22 |

| PRATEEK JOSHI | RAJESH KUMAR JOSHI | RAJESH KUMAR JOSHI 2/3 CHAMPA NAGAR BEAWAR RAJASTHAN 305901 AJMERRAJASTHAN 305901 | IN30051311794206 | 50 | 11-OCT-2029 | 2021-22 |

| ASHOK KUMARDEVICHAND LODHA | DEVI CHAND | DEVI CHAND A/3 VEER DURGADAS NAGAR PALI RAJASTHAN 306401 PALIRAJASTHAN 306401 | IN30051313347130 | 375 | 11-OCT-2029 | 2021-22 |

| POOJA TIKYANI | MOHAN LAL TULSANI | MOHAN LAL TULSANI 7 BAHARAVANI DHARM SHALA KE PICHHE WARD NO.27 BHILWARA RAJASTHAN 311001 BHILWARARAJASTHAN 311001 | 1201090002462138 | 12.5 | 11-OCT-2029 | 2021-22 |

| ASHOK KUMAR JAIN | CHITTAR MAL JAIN | CHITTAR MAL JAIN 44 C SHASTRI NAGAR CHITTAURGARH CHITTORGARH CHITTORGARH RAJASTHAN 312001 CHITTORGARHRAJASTHAN 312001 | 1208250027264499 | 37.5 | 11-OCT-2029 | 2021-22 |

| ANJANA MURDIA | LALIT MURDIA | LALIT MURDIA 4 MALI COLONY ROAD TEKRI OPP RADA JI TEMPLE UDAIPUR RAJ 313001 UDAIPURRAJASTHAN 313001 | 020625 | 750 | 11-OCT-2029 | 2021-22 |

| NASIR JAVED | MUSHTAQ HUSAINJI | MUSHTAQ HUSAINJI NASHEMAN 190 KHANJIPEER SOUTH UDAIPUR RAJ 313001 UDAIPURRAJASTHAN 313001 | 020628 | 750 | 11-OCT-2029 | 2021-22 |

| RANJEET SINGH CHANDALIA | MANGILAL JAIN | MANGILAL JAIN 116 HIRAN MAGRI SECTOR NO 3 UDAIPUR 313001 UDAIPURRAJASTHAN 313001 | 020630 | 500 | 11-OCT-2029 | 2021-22 |

| NATHU LAL SHARMA | KISHAN LAL SHARMA | KISHAN LAL SHARMA 122 RAO JIKA HATTA NEAR LASANI HOUSE UDAIPUR 313001 UDAIPURRAJASTHAN 313001 | 020635 | 750 | 11-OCT-2029 | 2021-22 |

| NARENDRA KUMAR JAIN | KUNDAN LAL JAIN | KUNDAN LAL JAIN 114 N ROAD BHOPALPURA UDAIPUR RAJASTHAN 313001 UDAIPURRAJASTHAN 313001 | IN30045013381425 | 500 | 11-OCT-2029 | 2021-22 |

| SUMITA KARN | VIRENDRA PRASAD VERMA | VIRENDRA PRASAD VERMA 32/21 KARJALY COMPLEX NEW SARDARPURA GIRWA UDAIPUR SHASTRI CIRCLE UDAIPUR RAJASTHAN 313001 UDAIPURRAJASTHAN 313001 | IN30021412679969 | 37.5 | 11-OCT-2029 | 2021-22 |

| DEEPESHKARVA | NOTAPPLICABLE | NOTAPPLICABLE S-4 SHYAM PLAZA KARWA MEDICAL 15-HIZARESWAR COLONY UDAIPUR RAJASTHAN 313001 UDAIPURRAJASTHAN 313001 | 1201700000128274 | 135 | 11-OCT-2029 | 2021-22 |

| JAMNA LAL SUTHAR | RODI LAL SUTHAR | RODI LAL SUTHAR S O RODI LAL SUTHAR BARI CHITTAURGARH RAJASTHAN UDAIPUR RAJASTHAN 313025 UDAIPURRAJASTHAN 313025 | 1204720025682739 | 16 | 11-OCT-2029 | 2021-22 |

| PRIYAL JAIN | NOTAVAILABLE | NOTAVAILABLE SINHAD RAJSAMAND RAJASTHAN 313301 RAJSAMANDRAJASTHAN 313301 | 1208160033272748 | 7.5 | 11-OCT-2029 | 2021-22 |

| BHERU LAL BHOI | MANGI LAL | MANGI LAL OGNA OGNA . . UDAIPUR RAJASTHAN 313906 UDAIPURRAJASTHAN 313906 | 1208870020371747 | 0.25 | 11-OCT-2029 | 2021-22 |

| BRIJESH KUMAR AGRAWAL | JAI DAYAL AGRAWAL | JAI DAYAL AGRAWAL KANSE MOHALLA PURANI DEEG BHARATPUR BHARATPUR RAJASTHAN 321203 BHARATPURRAJASTHAN 321203 | 1201770100841186 | 50 | 11-OCT-2029 | 2021-22 |

| SUDHIR KUMAR | DAMODAR LAL | DAMODAR LAL DAMODARLAL SUDHIR KUMAR OLD ANAJ MANDI GANGAPUR CITY 322201 SAWAI MADHOPURRAJASTHAN 322201 | 020847 | 250 | 11-OCT-2029 | 2021-22 |

| SOHAN LAL BAIRWA | NOTAVAILABLE | NOTAVAILABLE S/O AMAR LAL BAIRWACHORAGAON C CHORAGAON KARAULI RAJASTHAN 322203 SAWAI MADHOPURRAJASTHAN 322203 | 1208160083332331 | 11.25 | 11-OCT-2029 | 2021-22 |

| BALRAM MALI | BRIJ LAL MALI | BRIJ LAL MALI GERAI KARAULI KARAULI RAJASTHAN 322255 SAWAI MADHOPURRAJASTHAN 322255 | 1203320076322363 | 59.25 | 11-OCT-2029 | 2021-22 |

| NARENDRA NATH SHARMA | DINA NATH SHARMA | DINA NATH SHARMA KAGJI DEWARA BUNDI (RAJASTHAN) 323001 BUNDIRAJASTHAN 323001 | IN30105510539694 | 500 | 11-OCT-2029 | 2021-22 |

| NITIN CHANDEL | RAMSWAROOP CHANDEL | RAMSWAROOP CHANDEL S/O RAMSWAROOP CHANDEL PUROHIT JI TAPRI BHIMGANJ MANDI KOTA RAJASTHAN 324002 KOTARAJASTHAN 324002 | 1203320050364526 | 29 | 11-OCT-2029 | 2021-22 |

| VIKAS SINGHAL | ASHOK KUMAR SINGHAL | ASHOK KUMAR SINGHAL 5 I 39 MAHAVEER NAGAR III KOTA RAJASTHAN 324005 KOTARAJASTHAN 324005 | IN30045014263807 | 12.5 | 11-OCT-2029 | 2021-22 |

| MAHESHKUMARGUPTA | NOTAPPLICABLE | NOTAPPLICABLE VIMAL BHAWAN VIJAY MARKET GHANTAGHAR KOTA 324006 KOTARAJASTHAN 324006 | IN30105510518205 | 225 | 11-OCT-2029 | 2021-22 |

| ALOKVYAS | NOTAPPLICABLE | NOTAPPLICABLE 1-SA -11 DADABARI KOTA RAJASTHAN 324007 KOTARAJASTHAN 324007 | 1201060001564323 | 198 | 11-OCT-2029 | 2021-22 |

| ASHISH JAIN | S L JAIN | S L JAIN 369 SHASTRI NAGAR DADA BARI KOTA RAJ 324009 KOTARAJASTHAN 324009 | 020767 | 1250 | 11-OCT-2029 | 2021-22 |

| RENU GUPTA | MOHAN LAL GUPTA | MOHAN LAL GUPTA 239 SHASTRI NAGAR DADABARI DADABARI KOTA RAJASTHAN 324009 KOTARAJASTHAN 324009 | 1201770100454677 | 148.75 | 11-OCT-2029 | 2021-22 |

| HARSHITA NAGAR | NOTAVAILABLE | NOTAVAILABLE WARD NO. 5 WARD NO. 5 BARAN RAJASTHAN 325218 KOTARAJASTHAN 325218 | 1208160059648497 | 0.5 | 11-OCT-2029 | 2021-22 |

| JATINDER KOUR | H SINGH | H SINGH SARDAR GYAN SINGH BAZAR NO 3 RAMGANJ MANDI 326519 CHITTORGARHRAJASTHAN 326519 | 020790 | 1250 | 11-OCT-2029 | 2021-22 |

| KAILASH CHAND | NOTAVAILABLE | NOTAVAILABLE S/O SHOBHARAMWARD N 12 WARD N 12 KOTA RAJASTHAN 326519 CHITTORGARHRAJASTHAN 326519 | 1208160083443528 | 6 | 11-OCT-2029 | 2021-22 |

| SUNAYNA JAIN | MAHENDRA KUMAR SAVOT | MAHENDRA KUMAR SAVOT 2/164 KHANDU COLONY BANSWARA BANSWARA RAJASTHAN 327001 BANSWARARAJASTHAN 327001 | 1201320000342998 | 125 | 11-OCT-2029 | 2021-22 |

| MEHUL SOMPURA | OMPRAKASH | OMPRAKASH SHILPI MOHALLA BANSWARA RAJASTHAN 327025 BANSWARARAJASTHAN 327025 | 1204470023618684 | 13.75 | 11-OCT-2029 | 2021-22 |

| RAJESH KUMAR AGARWAL | SRINIWAS AGARWAL | SRINIWAS AGARWAL SRINIWAS SOM PRAKASH MAIN MARKET PO CHURU RAJ 331001 CHURURAJASTHAN 331001 | 020315 | 750 | 11-OCT-2029 | 2021-22 |

| KIRAN SHARMA | VINOD KUAMR | VINOD KUAMR 76 DHANUKA KUNE KE SAMNE WALI GALI WARD NO19 RATAN GARH TEHL. RATAN GARH CHURU RAJ 331022 CHURURAJASTHAN 331022 | IN30133020268177 | 50 | 11-OCT-2029 | 2021-22 |

| SURENDRA AGARWAL | SUKHLAL AGARWAL | SUKHLAL AGARWAL NOLARAM PAWAN KUMAR SARDAR SHAHR 331403 CHURURAJASTHAN 331403 | 020324 | 750 | 11-OCT-2029 | 2021-22 |

| BHANWARI DEVI PAREEK | BHIKHA RAM PAREEK | BHIKHA RAM PAREEK W/O BHIKHA RAM PAREEK VPO PULASAR TEH SARDARSHAHR SARDARSHAHR RAJASTHAN 331403 CHURURAJASTHAN 331403 | 1204470001390471 | 72.5 | 11-OCT-2029 | 2021-22 |

| BHAWANI SHANKAR | NOTAVAILABLE | NOTAVAILABLE 93 BIDASAR CINEMA HALL KE PAS BIDASAR CHURU RAJASTHAN 331501 CHURURAJASTHAN 331501 | 1208160070423320 | 25 | 11-OCT-2029 | 2021-22 |

| PALIDEVI GURJAR | S GURJAR | S GURJAR C/O S M GURJAR M K G BANK POST SUJAN GARH DISTT CHURU RAJASTHAN 331507 CHURURAJASTHAN 331507 | 020789 | 250 | 11-OCT-2029 | 2021-22 |

| GOVIND RAM SHARMA | BHANWAR LAL SHARMA | BHANWAR LAL SHARMA NEAR DSP OFFICE WARD NO 10 NH 65 OPP MARUTI GUARAGE SUJANGARH CHURU RAJASTHAN 331507 CHURURAJASTHAN 331507 | 1208180005748579 | 25 | 11-OCT-2029 | 2021-22 |

| ABADUL SATAR CHIMPA | HAZI GANI MOHAMED | HAZI GANI MOHAMED C/O MOHMAD AKARAM & CO CLOTH MARCHENT RAJALDESAR 331802 BIKANERRAJASTHAN 331802 | 020303 | 750 | 11-OCT-2029 | 2021-22 |

| KAPIL MEENA | MOOLCHAND MEENA | MOOLCHAND MEENA WARD 14 MEENA CHOUK RAJALDESAR RURAL CHURU RAJASTHAN 331802 BIKANERRAJASTHAN 331802 | 1203320088350462 | 24.5 | 11-OCT-2029 | 2021-22 |

| JAI SINGH BAID | BIJAY SINGH BAID | BIJAY SINGH BAID BIJAY DISTRIBUTORS POST. RAJALDESAR, DIST CHURU RAJASTHAN 331802 BIKANERRAJASTHAN 331802 | 020837 | 500 | 11-OCT-2029 | 2021-22 |

| RAM KISHORE AGARWAL | KESAR DEV AGARWAL | KESAR DEV AGARWAL SHOP NO 5 SHIV MARKET SURAJ POLE GATE SIKAR 332001 SIKARRAJASTHAN 332001 | IN30220111290263 | 175 | 11-OCT-2029 | 2021-22 |

| ANUP SARRAF | PAWAN KUMAR SARRAF | PAWAN KUMAR SARRAF P P AND SONS JEWLLERS SUBHASH CHOUK SIKAR RAJASTHAN 332001 SIKARRAJASTHAN 332001 | 1204470002831567 | 537.5 | 11-OCT-2029 | 2021-22 |

| GANESH CHANDRA SWAMI | NOTAVAILABLE | NOTAVAILABLE WARD NO 25 FATEH PUR SIKAR SIKAR RAJASTHAN 332301 SIKARRAJASTHAN 332301 | 1208160059361946 | 35 | 11-OCT-2029 | 2021-22 |

| MOHAMMAD ASALAM | ABDUL AJIJ | ABDUL AJIJ S O ABDUL AJIJ KANKRA SIKAR RAJASTHAN 33 SIKAR RAJASTHAN 332742 SIKARRAJASTHAN 332742 | 1204470021713920 | 23.5 | 11-OCT-2029 | 2021-22 |

| AKASH | NOTAVAILABLE | NOTAVAILABLE GOWLA JHUNJHUNU RAJASTHAN 333028 JHUJHUNURAJASTHAN 333028 | 1208160024907704 | 25 | 11-OCT-2029 | 2021-22 |

| SARITA DEVI SETHIA | DALCHAND DUGAR | DALCHAND DUGAR BAGINADA ROAD BANDRA BASH RANI BAZAR NEAR RAM MANDIR BIKANER RAJASTHAN 334001 BIKANERRAJASTHAN 334001 | IN30051318563599 | 25 | 11-OCT-2029 | 2021-22 |

| JYOTSANA PAREEK | NOTAVAILABLE | NOTAVAILABLE D/OAJAY KUMAR PAREEK PAREEKON BIKANER RAJASTHAN 334602 BIKANERRAJASTHAN 334602 | 1208160054099104 | 25 | 11-OCT-2029 | 2021-22 |

| GAUTAM BAID | RAJENDRA KUMAR | RAJENDRA KUMAR WARD NO 15 KANKARIYA CHOWK NOKHA BIKANER RAJASTHAN 334803 BIKANERRAJASTHAN 334803 | 1208180029960291 | 2.5 | 11-OCT-2029 | 2021-22 |

| MANJU VERMA | N K VERMA | N K VERMA C/O N K VERMA MAUSAM VIBHAG ASHOK NAGAR SRIGANGANAGAR 335001 GANGANAGARRAJASTHAN 335001 | 020322 | 500 | 11-OCT-2029 | 2021-22 |

| MANISH FALOR | KAILASHFALOR | KAILASHFALOR BIHANI BHAWAN 14 SUBHASH MARKET SRI GANGA NAGAR 335001 GANGANAGARRAJASTHAN 335001 | 020480 | 750 | 11-OCT-2029 | 2021-22 |

| RAJAN SHARMA | CHIRANGI LAL | CHIRANGI LAL 1 - C - 17 JAWAHAR NAGAR . SRI GANGANAGAR RAJASTHAN 335001 GANGANAGARRAJASTHAN 335001 | 1201910103147499 | 1250 | 11-OCT-2029 | 2021-22 |

| BUDHESHWARI GUPTA | SH HARISHCHANDER GUPTA | SH HARISHCHANDER GUPTA SH. HARISH CHANDER GUPTA WARD NO. 4 SANGRIA SANGRIA RAJASTHAN 335063 GANGANAGARRAJASTHAN 335063 | 1201210100464439 | 25 | 11-OCT-2029 | 2021-22 |

| VINOD KUMAR | NOTAVAILABLE | NOTAVAILABLE BIBIPUR HANUMANGARH RAJASTHAN 335503 HANUMANGARHRAJASTHAN 335503 | 1208160079296281 | 25 | 11-OCT-2029 | 2021-22 |

| MADAN LAL MALOO | BHANWAR LAL MALOO | BHANWAR LAL MALOO C/O POONAM SAREES 37 NAI SARAK JODHPUR RAJ 342001 JODHPURRAJASTHAN 342001 | 020135 | 750 | 11-OCT-2029 | 2021-22 |

| BRAJENDRA BHANDARI | RANJEET CHAND BHANDARI | RANJEET CHAND BHANDARI 440 B 3RD C ROAD SARDARPURA JODHPUR 342001 JODHPURRAJASTHAN 342001 | IN30018312444245 | 8.75 | 11-OCT-2029 | 2021-22 |

| RAVI SHEKHAR PHULPHAGAR | MAHAVEER RAJ JI | MAHAVEER RAJ JI 268 1ST POLO NEAR SHIP HOUSE PAOTA JODHPUR RAJASTHAN 342006 JODHPURRAJASTHAN 342006 | 1202000000064077 | 37.5 | 11-OCT-2029 | 2021-22 |

| SUDHIR KASHYAP | KUNDAN MAL KASHYAP | KUNDAN MAL KASHYAP HOUSE NO 01 DAU KI DHANISHIV LAL MAT HUR NAGAR JODHPUR JODHPUR 342008 JODHPURRAJASTHAN 342008 | IN30133040629737 | 100 | 11-OCT-2029 | 2021-22 |

| ASHOK KUMAR SOLANKI | FATA LAL | FATA LAL C/O DHARAM CHAND JAIN NAYA BAZAR PHALODI AR POST PHALODI 342301 JODHPURRAJASTHAN 342301 | 020805 | 500 | 11-OCT-2029 | 2021-22 |

| PADMA RATHORE | GOPAL SINGH RATHORE | GOPAL SINGH RATHORE THIKANA BADER BILARA DIST JODHPUR 342602 JODHPURRAJASTHAN 342602 | 020140 | 500 | 11-OCT-2029 | 2021-22 |

| MAHENDER SINGH RAJAPOOT | GANPAT SINGH RAJAPOOT | GANPAT SINGH RAJAPOOT S/O GANPAT SINGH BALI VALI NR GOVT HOSPITAL JALOR RAJASTHAN 343030 JALORRAJASTHAN 343030 | 1203320011292781 | 0.25 | 11-OCT-2029 | 2021-22 |

| BABU LAL BOHRA | MANGG DAS BOHRA | MANGG DAS BOHRA JUNA KERADU MARG BARMER RAJASTHAN 344001 BARMERRAJASTHAN 344001 | 1203320002206003 | 250 | 11-OCT-2029 | 2021-22 |

| NARESH KUMAR | NOTAVAILABLE | NOTAVAILABLE NERI NADI NERI NADI NERI NADI BARMER RAJASTHAN 344704 BARMERRAJASTHAN 344704 | 1208160077901814 | 0.5 | 11-OCT-2029 | 2021-22 |

| CHANDRAKANT J PAREKH | JETHA LAL | JETHA LAL C/O BAKUL SECURITIES 2 RAGHUVIRPARA PARA BAZAR RAJKOT 360001 RAJKOTGUJARAT 360001 | 020246 | 250 | 11-OCT-2029 | 2021-22 |

| JAYDEEP PUJARA | JANAK BHAI | JANAK BHAI C/O BHARAT RUBBER STAMPS G KUVA ROAD RAJKOT RAJKOT 360001 RAJKOTGUJARAT 360001 | 020249 | 250 | 11-OCT-2029 | 2021-22 |

| SHILPA PAREKH | SANJIV PAREKH | SANJIV PAREKH 408 EVEREST SUBASH RD OPP SHASTRI MAIDAN RAJKOT 360001 RAJKOTGUJARAT 360001 | 020256 | 250 | 11-OCT-2029 | 2021-22 |

| N N BHOGANI | NOTAVAILABLE | NOTAVAILABLE DARSHAN INDRAPRASTHA MARG NO 10 AKSHAR ROAD RAJKOT GUJRAT 360002 RAJKOTGUJARAT 360002 | 020796 | 750 | 11-OCT-2029 | 2021-22 |

| UMESH JAMNADAS LAVJI | JAMNADAS KANAHAILAL LAVJI | JAMNADAS KANAHAILAL LAVJI ANMOL 9/17 LAXMIWADI RAJKOT. 360002 RAJKOTGUJARAT 360002 | IN30097411321345 | 187.5 | 11-OCT-2029 | 2021-22 |

| DEVANG PANDYA | JAYANTI LAL | JAYANTI LAL 2 RAM NAGAR MARUTI GONDAL ROAD RAJKOT 360004 RAJKOTGUJARAT 360004 | 020250 | 750 | 11-OCT-2029 | 2021-22 |

| RAVI RAMESHBHAI KODINARIYA | RAMESHBHAI PARSOTAMBHAI KODINARIYA | RAMESHBHAI PARSOTAMBHAI KODINARIYA RANDAL KRUPA STREET NO-5 JASRAJ NAGAR KOTDASANGANI RAJKOT VAVDI 150 RAJKOT GUJARAT 360004 RAJKOTGUJARAT 360004 | 1301440003959900 | 0.75 | 11-OCT-2029 | 2021-22 |

| SULEMAN ISMAILBHAI BIJANI | I A BIJANI | I A BIJANI 33/14 BHAGWAT PARA GONDAL GONDAL GUJARAT 360311 RAJKOTGUJARAT 360311 | 1201090002590686 | 212.5 | 11-OCT-2029 | 2021-22 |

| PRAVINBA CHUDASAMA | HIMATSINH CHUDASAMA | HIMATSINH CHUDASAMA AMBER INDRA SAHAJANANDNAGAR MAIN ROAD GONDAL. 360311 RAJKOTGUJARAT 360311 | IN30097410618816 | 62.5 | 11-OCT-2029 | 2021-22 |

| NARANBHAI N BARAIYA | NARSHI BHAI | NARSHI BHAI KHARAVAD PLOT VIRPUR JALARAM DIST RAJKOT 360380 RAJKOTGUJARAT 360380 | 020248 | 1250 | 11-OCT-2029 | 2021-22 |

| RAJESHKUMAR H DHORIYA | HEMANTLAL DHORIYA | HEMANTLAL DHORIYA KADIAWAD MADHANI STREET JAMNAGAR. 361001 JAMNAGARGUJARAT 361001 | IN30097410711890 | 25 | 11-OCT-2029 | 2021-22 |

| DILIPKUMAR SOMCHAND GOSRANI | SOMCHAND PETHRAJ GOSRANI | SOMCHAND PETHRAJ GOSRANI SATISH SADAN 44 DIGVIJAY PLOT JAMNAGAR 361005 JAMNAGARGUJARAT 361005 | IN30103913563702 | 75 | 11-OCT-2029 | 2021-22 |

| ASHOKBHAI MATHURBHAI KOTADIYA | MATHURBHAI | MATHURBHAI SHOP 14 MOTI PALACE BUILDING OPP RAIJI NAGAR JUNAGADH GUJARAT 362001 JUNAGADHGUJARAT 362001 | 1203320002059244 | 5 | 11-OCT-2029 | 2021-22 |

| PIYUSH G KANABAR | GOVINDJIBHAI KANABAR | GOVINDJIBHAI KANABAR NR GIR DARWAJA MALIA HATINA GUJARAT 362245 JUNAGADHGUJARAT 362245 | 1203320002633128 | 2 | 11-OCT-2029 | 2021-22 |

| JOTANIYA BHIMJIBHAI T | THAKARSHIBHAI P JOTANIYA | THAKARSHIBHAI P JOTANIYA TURKHA ROAD JALARAM NAGAR BOTAD GUJARAT 364710 BHAVNAGARGUJARAT 364710 | 1203380000120367 | 12.5 | 11-OCT-2029 | 2021-22 |

| PARESHBHAI DUNGARSHI SHAH | DUNGARSHI TRYKAMDAS SHAH | DUNGARSHI TRYKAMDAS SHAH VAYADASAELO BHUJ-KUTCH BHUJ BHUJ GUJARAT 370001 KACHCHHGUJARAT 370001 | 1204470000436064 | 25 | 11-OCT-2029 | 2021-22 |

| KAUSHAL BHARAT THAKKAR | BHARAT | BHARAT C-201 RAWALWADI RILOKESHAN NARSINH MAHETA NAGAR HILL GARDEN PASE BHUJ GUJARAT 370001 KACHCHHGUJARAT 370001 | 1201330000194248 | 50 | 11-OCT-2029 | 2021-22 |

| AARTI VASWANI | MURLIDHAR N VASWANI | MURLIDHAR N VASWANI B NO 9 RADHA VALLABH COLONY MANI NAGAR AHMEDABAD 380008 AHMEDABADGUJARAT 380008 | 020039 | 250 | 11-OCT-2029 | 2021-22 |

| BHARATI DEVENDRA PATEL | DEVENDRA NATVERLAL PATEL | DEVENDRA NATVERLAL PATEL C-5 SHREYAS APT SHREYAS TEKKRA NR SHREYAS SCHOOL AHMEDABAD 380015 AHMEDABADGUJARAT 380015 | 020029 | 750 | 11-OCT-2029 | 2021-22 |

| PRADEEP CHANDUBHAI JAIN | CHANDU LALBHAVARLAL JAIN | CHANDU LALBHAVARLAL JAIN C/O STAR TREK ELECTRONICS KANCHAN DEEP SHOPPING SATALITE ROAD AHMEDABAD 380015 AHMEDABADGUJARAT 380015 | 020032 | 750 | 11-OCT-2029 | 2021-22 |

| GITA A PATEL | ASHWIN PATEL | ASHWIN PATEL 25 NEW GITANJALI SOC NR KAMESHWAR SCHOOL SETELITE RD AHMEDABAD 380015 AHMEDABADGUJARAT 380015 | 020274 | 500 | 11-OCT-2029 | 2021-22 |

| SMITA U PATEL | UMESH PATEL | UMESH PATEL 25 NEW GITANJALI SOC NR KAMESHWAR SCHOOL SETELITE RD AHMEDABAD 380015 AHMEDABADGUJARAT 380015 | 020275 | 1000 | 11-OCT-2029 | 2021-22 |

| SHAILESH PRAJAPATI | KARSHANBHAI PRAJAPATI | KARSHANBHAI PRAJAPATI B/9 RADHIKA PARK AMRAIWADI AHMEDABAD 380026 AHMEDABADGUJARAT 380026 | IN30123310265650 | 2.5 | 11-OCT-2029 | 2021-22 |

| AMIRUN NISHA SHAIKH | ABDUL BARI SHAIKH | ABDUL BARI SHAIKH F-21 SHANKLIT NAGAR JUHAPURA SHRKHEJ ROAD AHMEDABAD 380055 AHMEDABADGUJARAT 380055 | 020494 | 750 | 11-OCT-2029 | 2021-22 |

| CHIMANLAL AMTHALAL TRIVEDI | AMTHALAL MOHANLAL TRIVEDI | AMTHALAL MOHANLAL TRIVEDI 10 PRESIDENT PARK NR. SATYAM BUNGLOW OPP. SUVARNVILLA NR. AYNA COMPLEX THALTEJ AHMEDABAD GUJARAT 380059 AHMEDABADGUJARAT 380059 | IN30007910134678 | 25 | 11-OCT-2029 | 2021-22 |

| BHARATKUMAR NAGARDAS PARMAR | NAGARDAS PANJABHAI PARMAR | NAGARDAS PANJABHAI PARMAR 955/49 DHARNIDHAR AVENUE NR. RADHE RESIDENCY B/H SARJAN BUNGLOWS NAVA NARODA AHMEDABAD GUJARAT 382350 GANDHI NAGARGUJARAT 382350 | 1204470004826982 | 32.5 | 11-OCT-2029 | 2021-22 |

| APRAJITA GUPTA | PUROOSHOTTAM DAS | PUROOSHOTTAM DAS A/1/101 KARNAVATI APPARTMENT-2 NR. SHREE RAM RECIDENCY NAROL AHMEDABAD GUJARAT 382405 AHMEDABADGUJARAT 382405 | IN30021411516620 | 6.25 | 11-OCT-2029 | 2021-22 |

| KAMNI B KELLA | BHANWER LAL | BHANWER LAL A-17 JAS PARK PO ISANPUR AHMEDABAD 382443 AHMEDABADGUJARAT 382443 | 020495 | 500 | 11-OCT-2029 | 2021-22 |

| MOHMMADUSMAN HAJIBHAI RACHADIYA | HAJIBHAI RASULBHAI RACHADIYA | HAJIBHAI RASULBHAI RACHADIYA A-148 GHANCHIVAD KUNDI BAJAR GHANCHI NI MASJIDANI BAJUNO- VISTAR KADI DIST-MEHSANA KADI GUJARAT 382715 MAHESANAGUJARAT 382715 | 1204780000070356 | 50 | 11-OCT-2029 | 2021-22 |

| RAJKUMAR LADHARAM SINDHI | LADHARAM | LADHARAM NEAR CONTROL ROOM KALYANPURA TA KALOL KALOL GUJARAT 382721 MAHESANAGUJARAT 382721 | 1203320001164997 | 62.5 | 11-OCT-2029 | 2021-22 |

| CHANDRAHAS BIPIN KOTADIA | BIPIN K KOTADIA | BIPIN K KOTADIA 3 BAR BANGLA AT HIMAT NAGAR SABARKANTHA GUJARAT 383001 SABARKANTHAGUJARAT 383001 | 020041 | 1500 | 11-OCT-2029 | 2021-22 |

| RANJAN BIPIN KOTADIA | BIPIN K KOTADIA | BIPIN K KOTADIA 3 BAR BANGLA AT HIMAT NAGAR SABARKANTHA GUJARAT 383001 SABARKANTHAGUJARAT 383001 | 020042 | 1500 | 11-OCT-2029 | 2021-22 |

| BIPIN K KOTADIA | KAPILBHAI T KOTADIA | KAPILBHAI T KOTADIA 3 BAR BANGLA AT HIMAT NAGAR SABARKANTHA GUJARAT 383001 SABARKANTHAGUJARAT 383001 | 020043 | 1500 | 11-OCT-2029 | 2021-22 |

| CHHAYABEN C PRAJAPATI | MULJIBHAI | MULJIBHAI 66 KARNAVATI SOC SAHAKARI JIN ROAD HIMATNAGAR GUJARAT 383001 SABARKANTHAGUJARAT 383001 | 1304140001098561 | 2.5 | 11-OCT-2029 | 2021-22 |

| PARAG JITENDRAKUMAR MODI | JITENDRAKUMAR CHHOTALAL MODI | JITENDRAKUMAR CHHOTALAL MODI 12 A RAJDHANI CITY SOCIETY BEHIND RAJDHANI TAUSHIP MEHSAN MEHSANA I E TA DI MEHSANA MEHSANA GUJARAT 384002 MAHESANAGUJARAT 384002 | 1201090002277201 | 67.5 | 11-OCT-2029 | 2021-22 |

| ANILABEN KANUBHAI PRAJAPATI | KANUBHAI PRAJAPATI | KANUBHAI PRAJAPATI NANO VAS PRAJAPATI VAS HEDIYASAN TA AND DIST-MEHSANA 384002 MAHESANAGUJARAT 384002 | IN30305210514469 | 25 | 11-OCT-2029 | 2021-22 |

| ARVIND BHAI SHAH | NAROTTAM DAS SHAH | NAROTTAM DAS SHAH "ASHIRWAD" BANGLOW MAYURKUNJ SOCIETY V K V ROAD NADIAD 387001 KHEDAGUJARAT 387001 | 020342 | 1250 | 11-OCT-2029 | 2021-22 |

| DILIP JAYANTILAL SHAH | JAYANTILAL SHAH | JAYANTILAL SHAH 1879-B DALALWADA OPP. AJITNATH DERASAR KAPADWANJ 387620 KHEDAGUJARAT 387620 | IN30098210208911 | 25 | 11-OCT-2029 | 2021-22 |

| MOHINI D KHANAPUR | D | D SWAPNEEL DR COOL ROAD ANAND GUJARAT 388001 ANANDGUJARAT 388001 | 1201320000690082 | 328.25 | 11-OCT-2029 | 2021-22 |

| VIJAYKUMAR BHAGVANDAS PATEL | BHAGVANDAS PATEL | BHAGVANDAS PATEL AT JORAPURA TA. BALASINOR JORAPURA GUJARAT 388255 ANANDGUJARAT 388255 | 1201640000145040 | 375 | 11-OCT-2029 | 2021-22 |

| VEDNA A PATEL | ARVIND BHAII PATEL | ARVIND BHAII PATEL C/O ARVINDBHAI ISHWARBHAI PATEL 4/A CHAITANYA PARK, JITODIA ROAD AT. JITODIA, VIA. ANAND GUJARAT 388345 ANANDGUJARAT 388345 | 020343 | 500 | 11-OCT-2029 | 2021-22 |

| GOPAL RAMESHCHANDRA KHANDELWAL | RAMESHCHANDRA HANUMANDAS KHANDELWAL | RAMESHCHANDRA HANUMANDAS KHANDELWAL 22 SHRADDHA NAGAR MANDAV ROAD DAHOD. 389151 DAHODGUJARAT 389151 | IN30097411076805 | 175 | 11-OCT-2029 | 2021-22 |

| KETAN CHOKSHI | ISHWAR BHAI | ISHWAR BHAI B-54 SANTOSHI NAGAR NEAR MAHESANA NAGAR NIZAMPURA BARODA 390002 VADODARAGUJARAT 390002 | 020054 | 750 | 11-OCT-2029 | 2021-22 |

| KOKILA SATISH DESAI | SATISH J DESAI | SATISH J DESAI 167 C RAJLAXMI SOCIETY NR SHIVMAHAL OLD PADRA ROAD VADODARA GUJARAT 390007 VADODARAGUJARAT 390007 | IN30051312000042 | 50 | 11-OCT-2029 | 2021-22 |

| SANDEEP DURGANATH JHA | DURGANATH RAMCHANDRA JHA | DURGANATH RAMCHANDRA JHA A/1 24 YOGI RESIDENCY NEAR SOMNATHNAGAR TARSALI VADODARA GUJARAT INDIA 390009 VADODARAGUJARAT 390009 | IN30051316312996 | 5 | 11-OCT-2029 | 2021-22 |

| SANJAY C SHAH | CHANDU LALM SHAH | CHANDU LALM SHAH 701-A ARINANE COMPLEX OPP SBI MANJALPUR BARODA 390011 VADODARAGUJARAT 390011 | 020055 | 750 | 11-OCT-2029 | 2021-22 |

| RATAN SINH VAGHELA | D S VAGHELA | D S VAGHELA B-7 SAHAYOG GORWA REFINERY ROAD BARODA 390016 VADODARAGUJARAT 390016 | 020056 | 500 | 11-OCT-2029 | 2021-22 |

| KIRTI KHATRI | CHETAN KHATRI | CHETAN KHATRI 5 A SAHAJANAND APARTMENT TARANG SOC AKOTA STADIUM BARODA GUJARAT 390020 VADODARAGUJARAT 390020 | IN30021412198772 | 23.25 | 11-OCT-2029 | 2021-22 |

| BALVINDERSINGH P GHATHURA | PREMINDERSINGH JOGINDERSINGH | PREMINDERSINGH JOGINDERSINGH 163 RACHANA NAGAR BEHIND GEB BHARUCH GUJARAT 392001 BHARUCHGUJARAT 392001 | IN30051315311264 | 17.5 | 11-OCT-2029 | 2021-22 |

| KETAN BIPINCHANDRA GANDHI | BIPINCHANDRA GANDHI | BIPINCHANDRA GANDHI A/1 AMBICA NAGAR DEVI ROAD ANKLESHWAR GUJARAT 393001 BHARUCHGUJARAT 393001 | IN30051315104187 | 7.5 | 11-OCT-2029 | 2021-22 |

| DILIPBHAI LALLUBHAI PRAJAPATI | LALLUBHAI KARSANBHAI PRAJAPATI | LALLUBHAI KARSANBHAI PRAJAPATI KUMBHARWAD KANPURA TAL VYARA DIST TAPI 394650 SURATGUJARAT 394650 | IN30133020804760 | 125 | 11-OCT-2029 | 2021-22 |

| PURVI M GEHANI | MAHADEV K GEHANI | MAHADEV K GEHANI 402 SITA APARTMENT NANPURA MAIN ROAD SURAT GUJ 395001 SURATGUJARAT 395001 | 020261 | 750 | 11-OCT-2029 | 2021-22 |

| TEJAS RATILAL GANDHI | RATI LALSOMALAL GANDHI | RATI LALSOMALAL GANDHI 8/1793 KIRPA RAM MAHETA NO KHANCHOW GOPIPURA SURAT GUJ 395001 SURATGUJARAT 395001 | 020271 | 750 | 11-OCT-2029 | 2021-22 |

| SHAKUNTALA VINOD DESAI | VINOD KAKUBHAI DESAI | VINOD KAKUBHAI DESAI C-46 KISHORE PARK SOCIETY B/H ST XAVIERS SCHOOL GHOD DOD ROAD SURAT 395001 SURATGUJARAT 395001 | 020622 | 500 | 11-OCT-2029 | 2021-22 |

| MAYUR VINOD DESAI | VINOD KIKUBHAI DESAI | VINOD KIKUBHAI DESAI C-46 KISHORE PARK SOCIETY B/H ST XAVIERS SCHOOL GHOD DOD ROAD SURAT 395001 SURATGUJARAT 395001 | 020623 | 500 | 11-OCT-2029 | 2021-22 |

| NARESH KUMAR SHAH | AMRUTLAL SHAH | AMRUTLAL SHAH 303 A KALYAN APPARTMENT GAJJAR WADI ATHWA ST SURAT 395001 SURATGUJARAT 395001 | 020624 | 500 | 11-OCT-2029 | 2021-22 |

| VANITA DINESHCHANDRA SHROFF | DINESH CHANDRARAMANLAL SHROFF | DINESH CHANDRARAMANLAL SHROFF 5 1340 MOTI KALJUG HARIPURA BHAVANI VAD SURAT 395003 SURATGUJARAT 395003 | 020265 | 500 | 11-OCT-2029 | 2021-22 |

| NIDHI SUMIT AGARWAL | SUMIT AGARWAL | SUMIT AGARWAL 19 SAVITRI BUNGLOW VRINDAVAN PARK SOC RAHULRAJ MALL GALI DUMAS ROAD SURAT 395007 SURATGUJARAT 395007 | IN30021412236880 | 75 | 11-OCT-2029 | 2021-22 |

| MANI JEHANGIR | KAIZAD H JEHANGIR | KAIZAD H JEHANGIR 12 GEEWAN VIHAR SOCIETY OPP NAVYUG COLLEGE RANDER ROAD SURAT 395009 SURATGUJARAT 395009 | 020264 | 500 | 11-OCT-2029 | 2021-22 |

| KETAN JASHVANTRAI DESAI | JASHVANTRAI DESAI | JASHVANTRAI DESAI HANUMAN BHAGDA VALSAD 396001 VALSADGUJARAT 396001 | IN30177410973441 | 75 | 11-OCT-2029 | 2021-22 |